| Visitors Now: | |

| Total Visits: | |

| Total Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

LEAP 20/20: GEAB N°68, Global Systemic Crisis

by LEAP 20/20

“For several months we have anticipated a major shock for the economy and global political stability for Autumn 2012. We are maintaining this “Red Alert” and will take stock mid-November 2012, at the same time as our annual analysis of the 2013 “risk-countries”, and on the state of the world at this time.

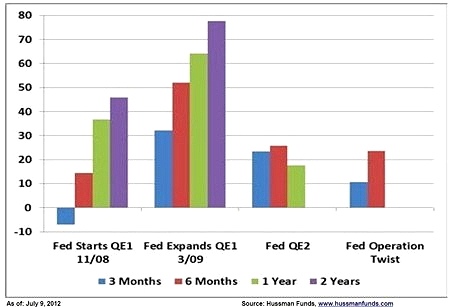

These last few weeks, as predicted by our team, the world geopolitical situation has rapidly deteriorated: the Syrian conflict has become a regional conflict in which the major powers are now trying not to be drawn in beyond the limits that they have set; to the North of the Sahel (Mali, Niger) a new military confrontation between Islamists and the West is in the offing; the China Sea has been turned into zone of “tepid” conflicts across the board with Japan and China in the middle of brewing chaos; the major world economies are all entering recession; social unrest is growing just like tax pressure, and there is no more liquidity available (even QE has an effectiveness in freefall as was still the case in 2009.

In this issue, our team thus takes stock of Western real estate prospects out to 2013 and adds a special anticipation “Netherlands Real Estate” due to the real estate crash in progress in this country. At the same time we continue to explore the socio-political consequences for 2013 of the increasing unrest in public opinion, concentrating here on the United States. Finally, after a review and a schedule of the main trends for the next few months, we expand on our recommendations concerning real estate, gold and the stock exchanges.

At the same time, against a backcloth of these Asian or Arab-Muslim conflicts, we are witnessing the widespread use of tests, by their allies and adversaries, of the extent of the weakening of US power. And each new week illustrates the increasing impotence of the “master of the end of the 20th century”: “the maker of Middle Eastern kings” of the 1990/2000 period must henceforth limit itself to contain the rejection of its presence and be on its guard against any obvious military action; and the “Pacific superpower” is from now on reduced to “counting the punches” between Japan, its historical strategic ally in the area, and China its principal geopolitical competitor but especially its principal economic, monetary and financial partner . And, for that matter, it really is here that the US “Achilles’ Heel” has increasingly serious consequences each day.

In addition to the extract of part of our analyses on the American real estate, which really confirms the entry of the Western property market into a long-term depression, we have chosen, in this GEAB N°68 press release, to present a number of graphs illustrating the smokescreen and manipulatory character of US economic statistics.

Our team has appreciated the fact that the electoral argument over the “official” US unemployment figures for September 2012 (a 0.4% fall) has allowed a far-reaching debate in the principal media on the “strange methods of calculation” of the US Ministry of Employment. It’s not the only one to massage the numbers but given the international media importance granted to these results, it appears useful that a greater number of players should be aware of it; and not only the enlightened readers of the GEAB and other teaching sites.

As regards China, the political transition in progress is proceeding with difficulty due to the global economic crisis which has finally caught up with the country (and all the BRICS) and of the need to invent a new course for the country’s strategy in order to face the double internal pressure of the risk of social explosion (we will return to this in detail in the November issue of the GEAB) and of regional and global geopolitical positioning. It’s not only the United States which has radically changed since 1990/2000!

The world order’s third major pillar (and in fact perhaps the most constructive for the future) is the European Union or, more exactly, Euroland. As anticipated by LEAP/E2020, the Eurozone is the only bearer of good news this Autumn. Of course, it’s very strongly overshadowed in the short run by the economic and budgetary consequences of the global systemic crisis (unemployment, recession, austerity,…), but for the medium to long term Euroland has finally committed itself to a “road which leads somewhere” after months of political impotence: powerful instruments are now available, the common political will to exit together has finally gained a foothold (as each Member State feels the impact of the crisis henceforth).

In terms of a schedule, LEAP/E2020 estimates that from now the timing is very clear: by the end of November 2012, the United States and China are each entering a double phase of historical domestic socio-political tensions before having to come to terms with the end of the period of “peaceful economic and commercial coexistence” of these last decades. By December 2012, Euroland exits, jogging along, as it usually does, from the “Euro crisis” and finds itself facing the triple challenge of its economic revival against the background of a global crisis, its institutional structuring against a background of imperative democratization and, coupled with that, the long term settlement of the British problem (in fact 26 versus 1).

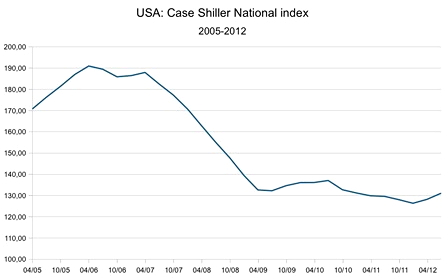

United States, “recovery” or smokescreen? The media would have us believe in a recovery in the US real estate market, based mainly on the Case-Shiller index shown on the chart below.

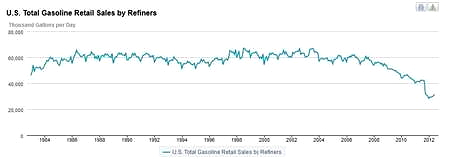

First, interest rates are at historically low levels (currently 3.39% for a fixed rate 30 year loan according to CNNmoney, which, on the one hand, allows some households, even largely insolvent, to return to the property market but, on the other and especially, allows investors to make good deals buying properties on the cheap repossessed by the banks. These transactions automatically increase prices. One will note all the same that interest rates have been extremely low for several years now and that the effect is only being felt now, a sign of the of the various players fragility and thus of the “recovery”. Unfortunately, interest rates at this level in no way reflects the health of the US economy and is only kept at that level thanks to the Fed’s repurchase of Treasury Bonds. In normal times, the various public plans of support for the economy should, for that matter, have had a much more marked upwards impact on real estate prices.

The second reason comes from the shortage organized by the banks which don’t want to resell houses seized at market prices to save their balance sheets. In fact, 90% of the foreclosures are retained by the banks. Millions of houses which will soon have to come on the market and which will lower prices; but for the moment the organized retention limits supply and creates a shortage pushing up prices.

And yet, it’s really the repossessions which reveal the real estate sector’s poor health in the United States. After a pause due to the banks’ robo signing scandal, the number of repossessions is on the rise again (we are talking of about three million repossessions a year). In fact, to understand the reality of the American property market, is a game just as cynical as it’s instructive: using the list of the largest American big cities (except New York) on Wikipedia, and counting the proportion of repossessions advertised in these cities on a website like Trulia , in spite of the many houses held on the banks’ balance sheets the conclusion is alarming: in the ten biggest US cities after New York, the proportion of adverts to repossessions is in the order of 56%, with cities like Los Angeles (the United States’ second city) or Chicago (the third) having a proportion of foreclosures of around 67%, not to mention, of course, Detroit or Miami where it culminates around 75%. One also notices that adverts where the price is falling are much more numerous than those where it is rising. Only New York seems to have a dynamic market, with almost no foreclosures and rising.

No more than in 2009, it shouldn’t be believed that the rise is lasting. It’s just another United States trick which one is now used to. And like all tricks, once understood, they reveal a much worse reality than one imagined… opening the door to panic! Remember Lehman Brothers… in a few hours the world moved from “normal” to “Red Alert” mode!”

2012-10-24 22:00:49

Source: http://coyoteprime-runningcauseicantfly.blogspot.com/2012/10/leap-2020-geab-n68-global-systemic.html

Source: