| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Trillion Dollar Crimes

Don’t Tread On Me – Divine Providence

Actual One Hundred Trillion Dollars of the Reserve Bank of Zimbabwe – I promise to pay to the bearer on demand One Hundred Trillion Dollars for the Reserve Bank of Zimbabwe – as is ALL IOU FED CENTRAL BANK FIAT TOILET PAPER “currency” created out of thin air backed by absolutely nothing.

Is this USA End the FED future ?

$2.3 Trillion then Secretary of Defense Donald Rumsfeld (FDA Aspartame Poison also) announces one day before 9/11/2001 that the The Military Industrial Complex / Pentagon lost/STOLE $2.3 Trillion. Then on 9/11 the part of the Pentagon that was destroyed by a missile was the records keeping department and poof the problem disappeared.

**********************

$200 Trillion in UNFUNDED MANDATES, liabilities, pensions, retirements (Not including ObamaCare or Illegal Immigrant Amnesty)

US Debt $200 Trillion + Laurence Kotlikoff

https://www.heartland.org/podcasts/2015/01/13/laurence-kotlikoff-true-us-debt-surpasses-200-trillion

http://dailybail.com/home/kotlikoff-the-government-is-lying-about-the-national-debt-it.html

https://2012patriot.wordpress.com/2015/03/11/us-debt-200-trillion-laurence-kotlikoff/

**********************

$700 Trillion in Derivatives, more likely US$ 1,600 Trillion used as collateral for the NWO 1% to manipulate & control global wealth, wars, dot com bomb, real estate collapse, precious metals, governments, nations, natural resources, energy, currencies, food supplies, LIFE & DEATH.

Total outstanding gross market value by 6 month period:

$707,568,901,000,000: How (And Why) Banks Increased Total Outstanding Derivatives By A Record $107 Trillion In 6 Months

Submitted by Tyler Durden on 11/26/2011 20:44 -0500

AIG American International Group Counterparties Gross Domestic Product Mean Reversion MF Global notional value OTC OTC Derivatives Volatility

While everyone was focused on the impending European collapse, the latest soon to be refuted rumors of a quick fix from the Welt am Sonntag notwithstanding, the Bank of International Settlements reported a number that quietly slipped through the cracks of the broader media. Which is paradoxical because it is the biggest ever reported in the financial world: the number in question is $707,568,901,000,000 and represents the latest total amount of all notional Over The Counter (read unregulated) outstanding derivatives reported by the world’s financial institutions to the BIS for its semi-annual OTC derivatives report titled “OTC derivatives market activity in the first half of 2011.” Said otherwise, for the six month period ended June 30, 2011, the total number of outstanding derivatives surged past the previous all time high of $673 trillion from June 2008, and is now firmly in 7-handle territory: the synthetic credit bubble has now been blown to a new all time high. Another way of looking at the data is that one of the key contributors to global growth and prosperity in the past 10 years was an increase in total derivatives from just under $100 trillion to $708 trillion in exactly one decade. And soon we have to pay the mean reversion price.

What is probably just as disturbing is that in the first 6 months of 2011, the total outstanding notional of all derivatives rose from $601 trillion at December 31, 2010 to $708 trillion at June 30, 2011. A $107 trillion increase in notional in half a year. Needless to say this is the biggest increase in history. So why did the notional increase by such an incomprehensible amount? Simple: based on some widely accepted (and very much wrong) definitions of gross market value (not to be confused with gross notional), the value of outstanding derivatives actually declined in the first half of the year from $21.3 trillion to $19.5 trillion (a number still 33% greater than US GDP). Which means that in order to satisfy what likely threatened to become a self-feeding margin call as the (previously) $600 trillion derivatives market collapsed on itself, banks had to sell more, more, more derivatives in order to collect recurring and/or upfront premia and to pad their books with GAAP-endorsed delusions of future derivative based cash flows. Because derivatives in addition to a core source of trading desk P&L courtesy of wide bid/ask spreads (there is a reason banks want to keep them OTC and thus off standardization and margin-destroying exchanges) are also terrific annuities for the status quo. Just ask Buffett why he sold a multi-billion index put on the US stock market. The answer is simple – if he ever has to make good on it, it is too late.

Which brings us to the the chart showing total outstanding notional derivatives by 6 month period below. The shaded area is what that the BIS, the bank regulators, and the OCC urgently hope that the general public promptly forgets about and brushes under the carpet.

Try not to laugh. Or cry. Or gloss over, because when it comes to visualizing $708 trillion most really are incapable of doing so.

Total outstanding gross market value by 6 month period:

There is much more than can be said on this topic, and has to be said, because an increase of that magnitude is simply impossible to perceive without alarm bells going off everywhere, especially when one considers the pervasive deleveraging occurring at every sector but the government. All else equal, this move may well explain the massive surge in bank profitability in the first half of the year. It also means that with banks suffering massive losses, and rumors of bank runs and collateral calls, not to mention the aftermath of the MF Global insolvency, the world financial syndicate will have no choice but to increase gross notional even more, even as the market value continues to get ever lower, thus sparking the risk of the mother of all margin calls: a veritable credit fission reaction.

But no matter what: the important thing to remember is that “they are all hedged” – or so they say, a claim we made a completely mockery of a few weeks back. So ex-sarcasm, the now parabolic increase in derivatives means that when the bilateral netting chain is once again broken, and it will be (because AIG was not a one off event), there will simply be trillions more in derivatives that no longer generate a booked cash flow stream for the remaining counterparty, until at the very end, the whole inverted credit0money pyramid collapses in on itself.

And for those wondering what the distinction is between notional and

Notional amounts outstanding: Nominal or notional amounts outstanding are defined as the gross nominal or notional value of all deals concluded and not yet settled on the reporting date. For contracts with variable nominal or notional principal amounts, the basis for reporting is the nominal or notional principal amounts at the time of reporting.

Nominal or notional amounts outstanding provide a measure of market size and a reference from which contractual payments are determined in derivatives markets. However, such amounts are generally not those truly at risk. The amounts at risk in derivatives contracts are a function of the price level and/or volatility of the financial reference index used in the determination of contract payments, the duration and liquidity of contracts, and the creditworthiness of counterparties. They are also a function of whether an exchange of notional principal takes place between counterparties. Gross market values provide a more accurate measure of the scale of financial risk transfer taking place in derivatives markets.

Well, no. It is logical that the BIS will advise everyone to ignore the bigger number and focus on the small one: just like everyone was told to ignore gross exposure and focus on net… until Jefferies had to dump all of its gross PIIGS exposure or stare bankruptcy in the face; so no – the correct thing to say is “gross market values provide a more accurate measure of the scale of financial risk transfer” if one assumes there is no counterparty risk. Because one the whole bilateral netting chain is broken, net becomes gross. And gross market value becomes total notional outstanding. And, to quote Hudson, it’s game over.

As for the largely irrelevant gross market value, which is only relevant in as much as it will be the catalyst which will precipitate margin calls on the underlying notionals, all $700+ trillion of them:

Gross positive and negative market values: Gross market values are defined as the sums of the absolute values of all open contracts with either positive or negative replacement values evaluated at market prices prevailing on the reporting date. Thus, the gross positive market value of a dealer’s outstanding contracts is the sum of the replacement values of all contracts that are in a current gain position to the reporter at current market prices (and therefore, if they were settled immediately, would represent claims on counterparties). The gross negative market value is the sum of the values of all contracts that have a negative value on the reporting date (ie those that are in a current loss position and therefore, if they were settled immediately, would represent liabilities of the dealer to its counterparties).

The term “gross” indicates that contracts with positive and negative replacement values with the same counterparty are not netted. Nor are the sums of positive and negative contract values within a market risk category such as foreign exchange contracts, interest rate contracts, equities and commodities set off against one another.

As stated above, gross market values supply information about the potential scale of market risk in derivatives transactions. Furthermore, gross market value at current market prices provides a measure of economic significance that is readily comparable across markets and products.

And here again, what they ignore to add is that the measure of economic significance is only relevant in as much as the world’s banks don’t begin a Lehman-MF Global tango of mutual margin call annihilation. In that case, no. They are not measures of anything except for what some banks plug into some models to spit out a favorable EPS treatment at the end of the quarter.

Expect to see gross market value declines persisting even as the now parabolic increase in total notional persists. At this rate we would not be surprised to see one quadrillion in OTC derivatives by the middle of next year.

And, once again for those confused, the fact that notional had to increase so epically as market value tumbled most likely means that the global derivative pyramid scheme (no pun intended) is almost over.

Source: OTC derivatives market activity in the first half of 2011 and Semiannual OTC derivatives statistics at end-June 2011

********************

The Trillion Dollar Crime Trial

by Benjamin Fulford September 3, 2010

The operation to flush out the leadership of the dark cabal has now zeroed in on the World Economic Forum at Davos, according to agents involved.

Italian P2 lodge member Daniel Dal Bosco, who has been under complete 24-hour surveillance since absconding with over $1 trillion in financial instruments, has led investigators to Giancarlo Bruno, “Head of the Financial Services Industry” at the World Economic Forum, investigators say.

The latest breakthrough in the ongoing criminal investigation has created a state of extreme tension in Western power corridors, especially Washington and Geneva.

“The world will not be the same when this is over,” a senior CIA source says.

The conversation intercepted between Dal Bosco and Bruno is like something out of a weird spy movie, the investigators say.

It can be paraphrased as follows:

Dal Bosco: “You need to help me, I am being followed by about 30 spaceships.”

Bruno: “I told you never to contact me, no matter what.”

According to investigators there are now more spies than normal citizens in the small Italian town where Dal Bosco is now staying and the pressure is beginning to wear on him. Neither Dal Bosco nor Bruno were available for comment at the time of this writing.

The trail from Bruno leads to the leadership of the United Nations as well as the Obama regime in Washington, the investigators say.

There is a long list of arrest warrants that has been readied and you can be sure a lot of people will be skipping the next Davos meeting out of fear of being arrested.

“The air in Washington is so thick now with tension that you could cut it with a knife,” a White Dragon Society source close to the action in D.C. says.

The tensions and divisions within the secret Western government are leading to ever more “incidents,” reaching the public eye.

In one incident, the body of Yuri Ivanov Deputy Head of GRU was found “accidentally drowned,” last week. He was in Syria helping prevent World War 3 from breaking out in the Middle East.

Then we have the case of MI6 Spy Garreth Williams, who was found stuffed inside a bag in his bathroom. The case is creating thick clouds of disinformation.

Then we have the on-again, off-again rape charges against Julian Assange of Wikileaks.

All these incidents point to deep division between various Western intelligence and police agencies. However, the Italians are looking especially isolated in all this.

In China, meanwhile, factional tensions are also rising with three main factions allying themselves with different factions in the battle for control over the financial system of the West.

There are also three factions in the West battling over the new financial system.

The incumbent faction is the New World Order faction that still hopes to start World War 3 and start a global fascist government.

Against them is the informal alliance that believes control over the world financial system should belong to the people of the planet

A third faction just sits on the fence waiting to ally themselves with the victor.

At the heart of this battle right now is the question of who will control the planned Amero currency.

Preparations for the launch of the Amero are now being finalized. Already the new gold-backed currency has been printed and distributed to the world’s various central banks. The governments of Canada and Mexico have also signed on. Average humans will be able to trade two dollars for one Amero.

see more about Amero: https://2012patriot.wordpress.com/?s=amero

see also Bancor : https://2012patriot.wordpress.com/2011/07/19/bancor-new-global-money/

see also Bitcoin: https://2012patriot.wordpress.com/2015/04/20/digital-gold-bitcoin-nathaniel-hopper/

The various countries holding US debt have each been offered their own rate. We do not know the details but have heard the Chinese got the best deal while the Japanese got one of the worst deals.

What remains to be decided is what sort of organization will oversee the creation and distribution of new Amero. That is why the operation to flush out the true owners of the Federal Reserve Board is crucial.

As for the Euro, so far no deal has been reached and the currency still appears to be doomed. Dust off your Deutschemarks if you have any is our advice.

Although the turbulence and tension is expected to continue possibly for another two years, it is quite clear that all the major global structures created after World War 2 will be totally changed when the dust finally settles.

The Trillion Dollar Criminal Case

…Against Top Davos, UN Officials & Others Will Go Ahead Despite Sudden Death of Key Witness by Benjamin Fulford September 6, 2010

Criminal charges will be filed this week in New Jersey in a $1 trillion robbery case that implicates top officials of the World Economic Forum (Davos) top United Nations officials including UN Secretary General Ban Ki Moon and members of the Italian P2 Masonic Lodge, according to top US law enforcement officials and lawyers for the owners of the over $1 trillion in stolen financial instruments.

The individual directly responsible for stealing the funds, P2’s Daniele Dal Bosco was recorded asking Giancarlo Bruno “Head of the Financial Services Industry” at Davos to have myself and three other individuals murdered.

In addition, Joe Bendana, the man who assisted in the case within the US on behalf of Neil Keenan and also provided affidavits to other governments and Interpol was also threatened directly by Dal Bosco 4 days before he was found murdered in his residence, Newark, New Jersey, last Saturday, September 4, 2010.

Police are treating the death of Bendana as a homicide because of the threats and because there was a security breach at his residence the night he died.

As soon as Bruno’s name was made public by this writer, we were contacted by a senior P2 Lodge member who offered “an international scoop,” involving impossible amounts of Philippine gold, UN Secretary General Ban Ki Moon and an individual by the name of Marco Di Mauro.

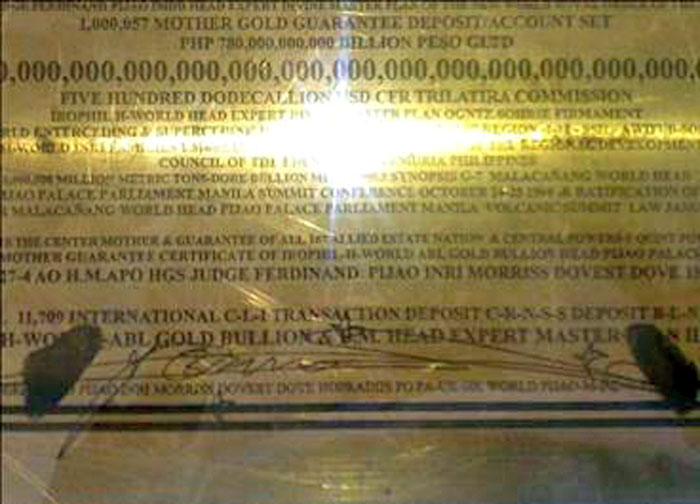

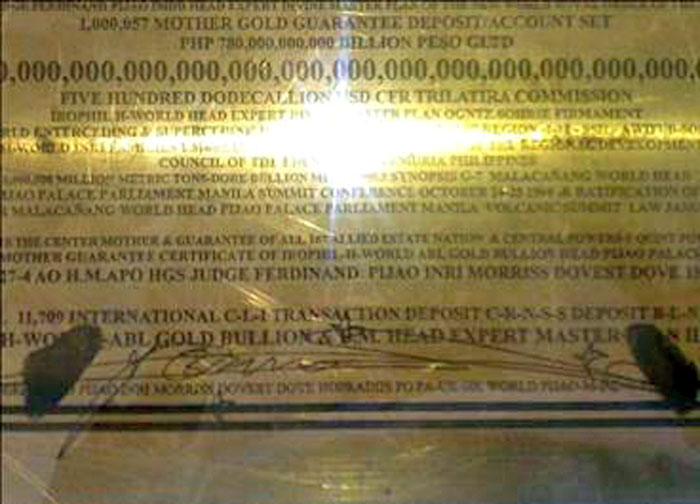

This photograph of an alleged Philippine bond worth “Five Hundred Dodecallion USD-CFR-Trilateral Commission,” was sent as proof.

There is no such number as a Dodecallion

but the “bond” had number 5 followed by 46 zeroes.

We are waiting for more coherent information from this source. The Trilateral Commission was founded in July of 1973. Clearly it does not fall in line with the date, October 24-25, 1966, issued on the Mother Gold Guarantee Deposit.

How could this have been issued when the Trilateral Commission did not exist at this time? I believe they are attempting to discredit this writer.

The entire incident began in June 2009 when two Japanese were illegally detained by Italian Treasury police and had $134.5 billion worth of bonds they were carrying confiscated. This incident was reported briefly in the international media before being dismissed as a “fraud.” However, the Japanese were not detained because they had diplomatic passports.

The bonds were real and were illegally confiscated by the Italian Treasury Police.

Shortly after this incident, the P2 Lodge, at the bequest of the Italian Police offered to assist them in cashing these bonds, which are owned by an astronomically wealthy Asian family. They offered the bonds back to this family at 10% of the face value but the family had no intention of allowing themselves to be extorted relating to bonds they already owned.

At a later date a family associate agreed to protect a further $1 trillion worth of financial instruments and they were placed into the custodianship of P2 “banker” Daniele Dal Bosco (Mr. Dal Bosco is actually not a banker nor ever has been a banker).

Dal Bosco then absconded with the bonds and tried to cash them variously with the UN with the assistance of Giancarlo Bruno of the World Economic Forum who is one of the coordinators. It is purported that Mr. Bruno set up the entire operation with the UN and OITC which Dal Bosco turned to for support once they recognized that Neil Keenan was not going to allow them to steal the bonds.

Dal Bosco states that he is working with his lawyer, Interpol and the UN but makes it perfectly clear to this writer that he refers everything over to OITC (he has no attorney holding the bonds to respond to), has never spoken to Interpol and the UN and Dal Bosco/Bruno/World Economic Forum/UN/David Sale/OITC are some of the known co-conspirators of this theft.

The OITC is headed by a Cambodian by the name of R.C. Dam.

Dam was at one point the designated heir of Indonesia’s Sukarno as signatory to a large pool of gold stored in various parts of Asia (This is the same gold that was supposed to back the new US dollar that President Kennedy was assassinated for trying to issue).

However, Dam was stripped of this power after the OITC was involved in a series of fraud cases. As a result, the bonds cannot be cashed by them. Italian Prime Minister Silvio Berlusconi also tried unsuccessfully to cash the bonds with the Chinese government.

Dal Bosco has been under complete surveillance since the beginning of this incident. That is why intelligence agencies recorded his requests for murder contracts and his threats to various individuals. Furthermore case files have been opened up against Dal Bosco in Milan, Italy and in Interpol.

Interpol is now actively involved as are most of the world’s intelligence agencies because they believe the trail in this case will lead eventually to the World Economic Forum, the UN and a group of Oligarchs who have been plotting to create a fascistic world government. These Oligarchs have also been trying to start World War 3 and carry out an unprecedented genocide of two thirds of the world’s population.

This case also illustrates some of the absurd and bizarre goings on now taking place in the esoteric world of high finance.

Senior sources report there is still chaos in the Western corridors of power, especially Washington D.C. because of the impending bankruptcy of the Federal Reserve Board.

There are moves, reported in our last newsletter, to launch a Gold Backed Amero to replace the US dollar. However, a different faction is still pushing for a Gold backed Treasury dollar controlled by the Congress. There is no conclusion to this fight but the turmoil is expected to intensify as the September 31 US fiscal year end approaches.

Because of this chaos Chinese and Asian sources are now offering to sell large denominations of US Dollars and Euros at a 37% discount to super-wealthy individuals.

The only thing that is certain about all these financial shenanigans is that the global governmental structures set up after World War 2 are all starting to collapse.

http://en.wikiversity.org/wiki/The_Trillion_Dollar_Crime_Trial

******************

More of the NWO plan: https://2012patriot.wordpress.com/?s=nwo

Who is the NWO ? : https://2012patriot.wordpress.com/2012/04/21/nobles-2/

Bilderbergers & Bohmenian Grove ? : https://2012patriot.wordpress.com/?s=bilderberg

Source: https://2012patriot.wordpress.com/2015/04/21/trillion-dollar-crimes/