| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Japan Today: Economists are fools

Musings On The Finite Statist Machine

|

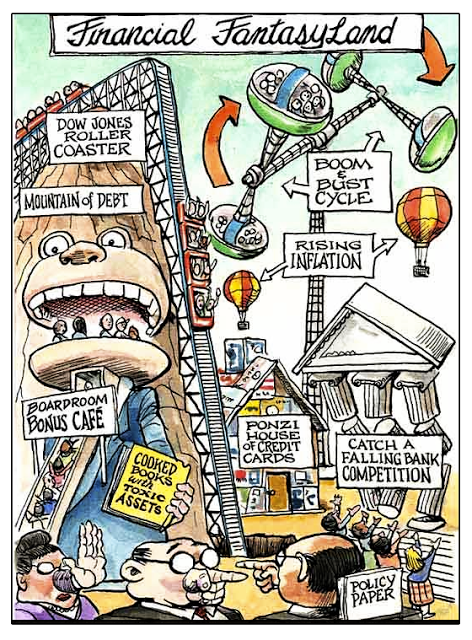

| Image courtesy http://www.ritholtz.com/blog/wp-content/uploads/2009/04/economist-financial-fantasy-land.png |

I’ve come to the conclusion that finance is a religion, and economists are the preachers who spread the catechism of capitalism. Problem is, a bit like how preachers haven’t a clue about things spiritual, the reality of finance is quite different that the orthodox dogmas taught by economics professors. Banking is about energy, the current of energy coming from humans (who are Source inbody), that current of energy is abstracted out by debt and converted to “currency” called money to hide where it all comes from, because, its comes from you and they don’t want you to know what is being stolen is your energy. One of the things that used to frustrate the heck out of me was they could never tell me in college, what money really was. Similarly physics professors could never tell me what time was. Turns out they couldn’t tell me because both are illusions. There is only energy, the flow of energy and NOW. -AK

http://www.japantoday.com/category/opinions/view/economists-are-fools

Economists are fools

by Dan Slater for EURObiZ Japan

OPINIONS NOV. 27, 2015 – 06:41AM JST ( 12 )TOKYO —

I hate to lead with such an aggressive title, but over the years, nobody (apart from bankers) has upset me more than economists.

I have been reading the stuff published by economists for decades. In China, where I worked for 12 years, GDP growth became like a religion. Thousands of articles were written on the topic, each of them quoting economists. In the process, the glorious city of Beijing was laid waste, but that is another story.

The malign and fruitless obsession with GDP growth, and the part played by economists in encouraging it, is why I think economists are fools.

Prime Minister Shinzo Abe is the latest leader to fret about GDP growth. Yet this is misguided, for several reasons.

GDP growth is merely a measure of activity. What growth per se does not reveal is the nature and quality of that activity. As most economists are actually well aware of, you can maintain GDP indefinitely if you are rich enough. For example, knocking down and re-building a house is a way of generating GDP, even if the various iterations of the building show zero improvement. Of course, at some point you will run out of money.

It is clear that GDP growth is a blunt, or even ‘dumb’, way of looking at the economy. My suspicion, however, is that this is precisely why it is so popular with politicians. Merely generating economic activity, especially in the short term, is quite easy — and, therefore, a convenient way for politicians to say they have achieved something during their term in office.

To generate GDP growth, you could build over-priced sports stadiums all over the country. Indeed, the more over-priced the said structures, the more GDP growth you will achieve — since the preferred measure is ‘nominal’ GDP, which measures the monetary amount of an activity.

Economists, of course, are clever enough to know all about the shortcomings of worshipping GDP growth, but they seem to want to make friends with policy-makers and obtain research grants, so they go along with it.

For Japan, GDP growth is especially pointless in two ways. First, it is far more important to look at GDP per person. For Japan, maintaining a non-shrinking GDP, or 0% growth, is a triumph in the face of the speed that the working population is declining.

It is a hollow triumph, however, because once the aim becomes to protect your GDP number, you do all sorts of extreme things, like using the central bank to buy up your government bonds. But by making an artificial floor, you make it impossible to know the real price of Japanese debt.

The price of government debt is the price off which all other financial instruments are abased, so you are making a mockery of your capital markets in the process. And, remember, the reason we pay bankers and economists such high salaries is that they allow us to identify the ‘true’ prices of goods and services in the economy. Only they don’t. But we still pay their level of salaries.

The distortions are obvious in other ways. Today, Japanese GDP is much bigger than it was before Abe came to power in December 2012, in yen terms. But the value of the yen has collapsed 40% against the dollar in that time. So in dollar terms, it has sharply contracted.

Everyone wants a simple metric, and GDP growth is the metric incessantly recycled in almost every article about Abenomics. The prime minister was recently brazen enough to suggest a GDP of ¥600 trillion — a typically pointless numerical figure.

That is the reason why printing money has become so central to the debate about Abenomics. Printing money should make prices go up, and that lifts nominal GDP. Hey, presto, mission accomplished! This then leads you into truly wacky territory where rising prices — in a country where most people have been growing poorer over the last 20 years — is seen as a good thing. But, hey, nominal GDP is growing — at least in the short term.

If you choose one bad metrics, you start having to use lots of other absurd metrics to achieve the original metric. Unfortunately, none of this looks likely to change soon.

External Link: http://eurobiz.jp/

Source: http://americankabuki.blogspot.com/2015/11/japan-today-economists-are-fools.html