| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Wall Street Meltdown Smash-up Live Coverage Updated: Armageddon/Apocalypse/Last Judgment’s Day (Video Gallery Links)

King of Shambhala

also see here for me….I belong to an old Norwegian aristocratic ROYAL family including Count Tolstoy (Leon Tolstoy, the famous Anarchist theorician inspired the Russian Revolution but at the same time was the scion of the Chernigov Princes – 11th cent. – by far the oldest Russian royalty), Henrik Ibsen, Papal and Royal Chamberlains, many Members of the Royal Household, (Mistresses of the Robe) barons and counts, ambassadors. All those who fail to heed heaven’s voice (the lottery draw of 666 below) will be thrown into hell in the end times says the Bible. Well, heaven has spoken. On the day after Obama’s election the lottery in his homestate drew 666. The 666 lottery-draw also reveals that Obama’s Mark of 666 means his money. Check the lottery numbers in Obama’s homestate here : the Pick 3 of Nov 5, 2008 was 666, less than 24 hours after Obama’s election!! Because I’m alone in revealing the lottery draw of 666, the Mark of the Beast that everybody knows is the Antichrist, that makes me the Messiah and Jesus’ Second Coming. Tibetan Tantric Buddhism is the highest form of culture in the world and I follow it’s Kalachakra creed. Buddhism and Hinduism never carried out war like Christianity and Islam (That’s the worst thing existing in the world.) I’m working on revealing myself and my message to the world fast now so the Apocalypse blows. My message of truth and that shows the way, must be revealed not only here at BIN (the only place in the world where speech is free), but worldwide even in Asia, on all media everywhere, in each country, to all people

Updated: Wall Street Dow Jones down close to 1% at 10 AM.

Update at 10:15 AM: Dow is 1,03% down.

Update - 12 AM: stocks slide gains speed: down 1,35%.

Updated – 2 PM: down 1:50%!

Updated CLOSE at almost 1,50%….

Traders Bemoaning Lack of Shock, Awe in Markets Finally Get Some

-

Friday’s selloff has traits common with past volatility shifts

-

Investors enduring a third day of elevated turbulence.

Traders who complained all summer about markets stuck in a zombie state are getting what they wanted, and probably will be for a while.

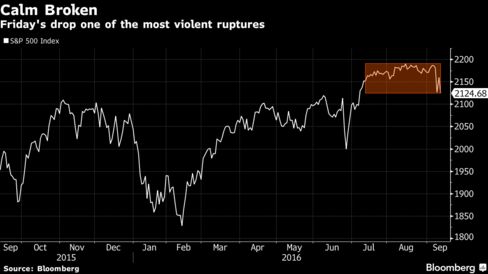

Eruptions of volatility this big rarely go away quickly. By one measure, the selloff ripping equities represents the sixth most violent rupture to market calm in history, with the S&P 500 Index’s drop of 2.5 percent exceeding its daily move in the prior month by a factor of 10. Every time that happened in the past, turbulence took its time petering out.

Patterns like that may affirm the view of bears who spent July and August warning that the peace blanketing everything from equities to bonds and currencies was likely to end in a bang, not a whimper. Of particular concern right now is the concerted nature of the selloff in which markets that don’t ordinarily move in the same direction suddenly are.

“When investors come back from the beach and start thinking about, ‘How am I going to prepare for the fourth quarter?’ we’re going to see a lot of activity,” said Brad McMillan, chief investment officer of Commonwealth Financial Network in Waltham, Massachusetts, which oversees $100 billion. “Volatility doesn’t go away. It gets stored up.”

Stocks and bonds plunged in tandem for the second time since Friday, driving measures of volatility higher as investors lost confidence central banks still have ammunition to promote growth. U.S. stocks notched their third straight move of at least 1 percent after 43 days without one, while Treasury yields were jolted out of the tightest monthly range in a decade. Oil joined the selloff, punishing currencies of resource exporters and leaving investors with few places to hide.

Among the pressure points:

- Lockstep drops. A gauge tracking hedge fund strategies that balance bets over markets, the Salient Risk Parity Index, plunged the most since August 2015 on Friday.

- Tepid data. Bloomberg’s index of economic surprises turned negative for the first time since July.

- Earnings estimates. Analysts see S&P 500 profits falling 1.4 percent in the third quarter, almost double the drop they saw a month ago.

“People are certainly on edge around here,” said Robert Pavlik, who helps oversee $9.1 billion as chief market strategist at Boston Private Wealth. “The one saving grace is that we as a firm have some cash on the sidelines, but that doesn’t do any good when you’re still 90 percent invested in equities. You can’t help but feel some pain.”

Two months of tranquility was pierced Friday when the S&P 500 tumbled in its worst rout since the U.K. voted to leave the European Union. Angst as measured by the CBOE Volatility Index climbed 21 percent as of 4 p.m. in New York Tuesday after increasing Friday by 40 percent, its biggest gain in three months.

Things aren’t any better in the $13.6 trillion Treasury market. Ten-year notes were stuck in their tightest monthly range in a decade up until September, while implied volatility in global currencies was near the lowest this year before surging at the quickest pace since the June 23 Brexit referendum, a JPMorgan Chase & Co. index showed.

For bond traders at Pioneer Investment, the stress represents vindication. The firm has been betting against longer-dated Treasuries, a losing trade for most of this year until last week.

“We were very pleased that the strategy finally seems to be working,” Paresh Upadhyaya, director of currency strategy in Boston at Pioneer, which oversees about $236 billion. “Is the global rise in yields a structural change, meaning we’ve seen the bottoming in yields or is this another head-fake that’s roiled fixed-income from time to time? This time feels different.”

Stocks exited the tightest trading range in history last week when European Central Bank President Mario Draghi downplayed the need for more measures to boost growth and Boston Fed President Eric Rosengren warned against waiting too long to raise interest rates. While equities rebounded after Fed Governor Lael Brainard urged prudence in raising rates, they succumbed anew Tuesday with valuations sitting near the highest level in more than a decade.

“Everyone was out for the summer. Now all of a sudden people are asking ‘Are they going to raise interest rates?”’ said Bruce Campbell, fund manager with StoneCastle Investment Management in Kelowna, British Columbia. His firm manages about C$100 million. “People were running out on Friday, then they were running back in yesterday, now they’re running for the exits again today. It’s a crazy, bipolar stock market.”

Such abrupt breaks in calm have not been easily resolved in the past. In the five prior instances when turbulence spiked as it did Friday, the S&P 500’s daily swings averaged 1.5 percent in the next 20 days. That’s 2.5 times the move in the previous 20 days, data compiled by Bloomberg and Bank of America Corp. show.

Markets look fragile, Bank of America analysts led by Abhinandan Deb wrote in a note to clients Tuesday. “We believe a bona fide bond shock remains a key destabilizing risk to markets, particularly if catalyzed by a loss of confidence in central banks.”

It’s been a while since a protracted decline took hold. Following Britain’s decision to exit the European Union, the S&P 500 dropped 5.3 percent over two days, only to rally the next four and erase the entire plunge two weeks later. Two 10 percent corrections that began in August 2015 and January 2016 also proved short-lived.

That’s not to say that stocks will follow the same route this time. With S&P 500 profit in the worst decline since 2009 and presidential elections looming, the list of reasons for the second-longest bull market to strengthen is getting shorter. While improved economic data helped fuel the S&P 500’s 20 percent rally from a February low, signs of weakness are emerging.

All year bulls have pointed to an element missing from market psychology and said it would prevent a full-blown selloff — overconfidence. But signs of exuberance have been multiplying in the market, including record high levels of bullish holdings by hedge funds in index futures contracts and unrepresented short positions in VIX futures.

“There is just this steady crowding into stocks because that’s the only place to generate returns. That’s a pretty complacent approach,’’ said Eric Schoenstein, Portland, Oregon-based co-manager of the $5.4 billion Jensen Quality Growth Fund. “When you take your eyes off the potential for risk, that’s when you can really get harmed as an investor.’’

The Fall of Hillary Clinton

The signs of financial Apocalypse stack up as Hillary goes AWOL and Missing In Action, Obama has no one between him and people hounding him for the birth certificate like Trump, Joe Arpaio, Orly Taitz etc….Hillary was a birther too….Trump’s policies promise to put the markets through a wringer…the world markets are looking at total instability and no calm on the markets for any forseeable future.

US STOCKS SNAPSHOT-Wall St opens lower as oil prices slide

Sept 13 - Wall Street opened lower on Tuesday, with energy stocks falling on lower oil prices and financials hit by diminished prospects of an interest rate hike in the near term.

The Dow Jones Industrial Average was down 101.46 points, or 0.55 percent, at 18,223.61.

UPDATED!

Wall Street dragged lower by energy, financials

Wall Street opened lower on Tuesday, with energy stocks falling on lower oil prices and financials hit by diminished prospects of an interest rate hike in the near term.

Oil prices were down more than 1 percent after a report from the International Energy Agency added to concerns about global oversupply. [O/R]

All 10 major S&P 500 sectors were lower, with the energy index’s 1.56 percent fall leading the decliners. The financial index was down 1.43 percent.

U.S. stocks had racked up their strongest gain in two months on Monday after Federal Reserve Board Governor Lael Brainard stuck to her dovish stance on interest rates and urged caution about removing monetary stimulus too quickly.

However, any sense of calm in markets looked fragile after three volatile trading days, especially on Friday, that saw bond yields soar and stocks rack up heavy losses on concerns that the Fed would raise interest rates at it Sept 20-21 meeting.

“The market is in a downward spiral and needs to complete the pullback it began last Friday,” said Peter Cardillo, chief market economist at First Standard Financial in New York.

“Falling oil prices and the election is also causing some uncertainty and traders are caught in the middle of a divided Fed.”

http://news.myonlineportal.net/news/wall-street-dragged-lower-at-open-by-energy-stocks-financials

Stock slide gains speed as oil plunges and Dow off 200+

Yesterday’s big bounce on Wall Street isn’t sticking.

http://news24.onthewifi.com/news/stock-slide-gains-speed-as-oil-plunges-and-dow-off-200

Global stocks fall with energy shares; oil prices drop

NEW YORK – World stock markets and energy prices fell on Tuesday after both energy producers and consumers predicted an oil glut was likely to persist well into next year.

NNOOOO COMMENTS???

Ignore the homos heckling my articles.

Jesus said sodomites go to hell’s fire and sulfur lake and roast there forever, eternally.

Just sayin’ I’d avoid it if I were you.

Remember what I’ve said millions of times: I AIN’T GOING TO HEAVEN WITH YOU DELUSIONS – I’LL TO GO HEAVEN ON MY OWN MERITS.

And I’ve got more than you as far as MERITS are concerned. Wacko!

Don’t respond to crazies who troll says Wikipedia.

Homos like Big dog…/small fish…will go to hell.

Jesus said so categorically not me: “Turn from Sodom for they will burn in the lake of fire and sulfur eternally” he said saying to turn from Sodom and Gomorrah and to flee those places.

I have news.

Jesus was right.

Homos are responsible for 95% of HIV/AIDS says Obama’s disease-control website CDC.

Homos have 28 to 35 years’ shorter life spans than us straights.

They like Obama because he’s an old black homo commie, Islamo-Christian-Jewish, fraud, criminal, illegal undocumented alien, and the Democrats knew that by choosing him, they’d shame blacks for all Eternity.

Yes indeed, that’s because the DNC are racists and wish ill on all blacks (remember the DNC created the KKK to kill black and white GOP – which is the party of Lincoln and freed the slaves – the DNC is the party of slavery and of shaming blacks like they proved by electing Obama. He’s going to shame the black race when he gets led away soon in handcuffs and then tried in court and jailed for ever for his High Treason. Obama’s the DNC’s fall-guy. Shame on the DNC. They’re just 100% liars.)

Being of royal lineage has prepared me to take back the power from the frauds holding it: the Left.

I’m the Messiah stepping forth and assuming the power.

This is it!

I’m of royal lineage.

The homos heckling me are trolls with mental derangement says Wikipedia.

Jesus warned against homos.

He said “leave Sodom”.

Sodomites are demonics said Jesus. It’s bad karma to be a homo sodomite.

Beware of false christs infesting the comments here.

Those who are false christs are morons and ugly.

The Apocalypse will come and smite the Antichrist Obama out of nowhere and you have no control of the future at all because you’re just a fraud.

I come from a royal lineage and my forerunners had visionnary premonitions of the world’s future.

The mentally deranged trolls in the comments have been reported before for making threats including death threats and been banned.

Wikipedia says trolling is a deranged pathological disorder.

Watch out for dangerously deranged criminal pathological cases infesting these comments.Sodomites are infecting these comments.

Jesus warned against false christs corrupting the Christian Church in the end times.

Don’t follow them, they’re homos, commies, Islam-lovers and garbage.

Throw them away like crap.