| Online: | |

| Visits: | |

| Stories: |

Nothing has been fixed – Citi’s five reasons why this sucker is going down!

Full article at:

https://news-uncensored-fresh.blogspot.be/2016/05/nothing-has-been-fixed-citis-five.html

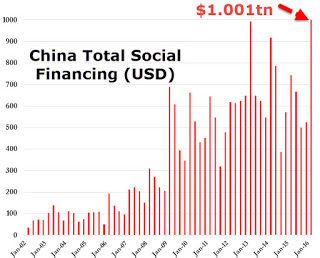

As a result of the dramatic surge in the S&P500 from its February lows, which erased the worst ever start to a year, and nearly regained the all time highs in the US stock market on a combination of a central bank scramble to reflate, the “Shanghai Accord”, and the most violent short squeeze in history, coupled with a historic credit injection by China which as we firstreported amounted to a record $1 trillion in just the first three months of the year…

… economists have shelved discussions about the threat of a US recession.

That is a mistake.

According to Citi, the Q1 2016 stabilization in Chinese, EM and global growth looks fragile and is likely to be temporary. In other words, nothing has been fixed. In fact, Citi goes on to say precisely that:

In particular, none of the structural headwinds that seem to have plagued the global economy in recent years (a mix of excessive indebtedness, deteriorating demographics, rising political uncertainty as well as the end of the China growth miracle and the commodity supercycle)have been resolved.

Looking forward, these are the four key risks that keep Citi up at night “in the near term.”

The Chinese stabilization could be even more short-lived than we currently expect. As noted above, the duration of China’s old-style investment-led fiscal stimulus and credit binge may prove rather short, as Chinese policymakers pivot back and forth between supporting growth and supporting reform and rebalancing. In the light of the evident imbalances and excesses in the Chinese economy, the Chinese stimulus may also prove to be less effective in sustaining aggregate demand – even in the short run – than hoped for.

One contributor to the potential stabilization in China’s and EM activity has been the weaker US dollar and receding expectations of a US rate hike. But these may well prove temporary. In particular, financial markets probably currently underprice the risk of Fed rate hikes over the next year or two (our US team currently expects one more hike in 2016, probably in September, but the next hike could also happen in June or, more likely, July). It remains to be seen whether EM financial conditions and the tentative stabilization in EM economic activity would prove resilient to renewed Fed tightening and dollar strength.

A US downturn could threaten. The recent weakness in the US data, continued cautious behavior of US consumers, and the lack of “animal spirits” to raise investment spending leave questions as to whether there may be further economic weakness to come.

Political risks in Europe are high and rising. The UK’s upcoming EU referendum (June 23) remains a key uncertainty for the coming months and we believe Brexit, if it happens, would be a major negative in economic and political terms for the UK and EU as a whole. We still put the probability that the UK votes to leave the EU at 30-40% – i.e. not our base case but by no means a trivial risk – but there are some reasons to think that the risk may be even higher. And Brexit is by no means the only source of political uncertainty and risk in Europe, with new elections due in Spain, high support for non-mainstream parties in many countries including Austria, France, Italy, the Netherlands, Sweden, Denmark, Hungary, Poland and Slovakia, and rising non-mainstream support even in Germany.

Read more at:

https://news-uncensored-fresh.blogspot.be/2016/05/nothing-has-been-fixed-citis-five.html