| Online: | |

| Visits: | |

| Stories: |

Take your Money Out of the Bank While You Can – Beware the Ides of March

Beware the Ides of March, so says economist Robert Kudla, whom I am interviewing this coming Sunday night. There is a major economic action planned. More on that later. Right now, I am issuing a major alert to remove your money from the bank.

Your surface list to survive what is coming is

- Food

- Water

- Guns

- Ammo

- Gold

- Support of others

Do you now how to take your money out without going to jail? The system is working against you? If you have no idea what you are doing this is must reading.

Can you find yourself in the above picture? Don’t be “that guy”. These people will end up living under a cardboard box or they will forced to go to a FEMA camp for food and water?

I am going on the recording by predicting that the Federal Reserve will steal your money by faking a cyber attack. In fact, FEMA and DHS actually practiced for this event on October 23rd and 24th of 2013. As I wrote on June 12, the Federal Reserve, the FDIC and the Bank of London practiced for widespread banking failure on November 10, 2014. On November 16, 2014, the G20 nations declared your bank deposits to not be money and they can take it whenever they want. On August 8, 2012, the 7th Circuit Court of Appeals ruled that the banks own your money when you deposit your paycheck into the bank.

The Most Requested Subject In the History of The Common Sense Show

I have been inundated with requests for more information on how to get your money out of the bank. If you think your money is safe while sitting in the bank, you desperately need to do some investigation. S&P has previously downgraded the 8 major banks in the United States. They are already in a lot of trouble.

There is no doubt that anyone who leaves all of their money in the bank needs their head examined. However, if you walk up to your “friendly” teller and ask to withdraw all, or most, of your money, you will either be shown the door and/or arrested for violating federal banking laws. Yes, it is now a crime to take your own money out of your own bank account, just ask former Speaker of the House, Dennis Hastert who has been indicted and now convicted for taking HIS money out of HIS bank account.

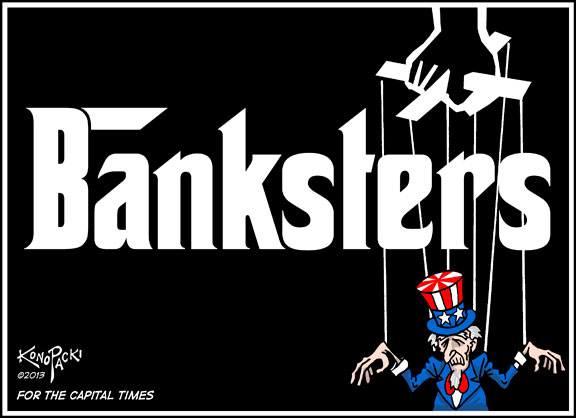

Even Congressmen Aren’t Safe From the Banksters

Federal prosecutors charged and convicted a former Republican House speaker, Dennis Hastert, with illegally structuring cash withdrawals from bank accounts which were designed to conceal payments to someone he committed “prior misconduct” against and Hastert is also accused of lying to the FBI about the event. The indictment did not specify who Hastert was paying off for his prior misconduct, but anonymous sources allege that Hastert had sexual contact with a minor when he was a high school wrestling coach and the former student was extorting the former Congressman. A total of $3.5 million was involved according to the prosecutors. The important point to consider here is that this former Congressmen is not headed to prison for sex with a minor, or facilitating a bribe, he is headed to prison for TAKING HIS OWN MONEY OUT OF HIS BANK ACCOUNT!

You should be concerned with going to prison. There is no question that you need to take the majority of your money out of the bank, IMMEDIATELY, but what are the pitfalls in doing so? What should every American know prior to attempting to liberate the fruits of their own labor from the bankster controlled central bank?

The Three Laws You Must Know Before Taking Your Money Out of the Bank

Taking what was your money out of the bank is no longer a matter of walking up to your friendly teller with a withdrawal slip and the teller cheerfully honors your request and you calmly exit the bank with your money in tow. In fact, your teller is trained to look for certain indicators in any cash withdrawal of any significance.

As you move to withdraw the bulk of your money, there are three federal banking laws that you should be cognizant of, namely, Cash Transaction Report (CTR), a Suspicious Activity Report (SAR) and structuring. Before proceeding with the planed withdrawal of your money, I would strongly suggest that you read the following federal guidelines as it relates to CTR’s as produced by the The Financial Crimes Enforcement Network (FinCEN). All the federal regulations contained in this article are elucidated in this series of federal reports.

Before withdrawing your money, please be aware of these three regulations related to getting your money out of the bank.

(1) CTR

Federal law requires that the bank file a report based upon any withdrawal or deposit of $10,000 or more on any single given day.The law was designed to put a damper on money laundering, sophisticated counterfeiting and other federal crimes.

To remain in compliance with the law, financial institutions must obtain personal identification, information about the transaction and the social security number of the person conducting the transaction.

Technically, there is no federal law prohibiting the use of large amounts of cash. However, a CTR must be filed in ALL cases of cash transaction regardless of the reason underlying the transaction. This means your cash transaction will be on the radar.

(2) Structuring and (3) SAR

There will undoubtedly be some geniuses whose math ability will tell them that all they have to do is to withdraw $9,999.99 and the bank and its protector, the federal government will be none the wiser. It is not quite that simple. Here are a few examples of structuring violations that one should be aware of:

1. Barry S. has obtained $15,000 in cash he obtained from selling his truck. He knows that if he deposits $15,000 in cash, his financial institution will be required to file a CTR. Instead he deposits $7,500 in cash in the morning with one financial institution employee and comes back to the financial institution later in the day to another employee to deposit the remaining $7,500, hoping to evade the CTR reporting requirement. Barry should have used multiple accounts to conduct this transaction.

2. Hillary C. needs $16,000 in cash to pay for supplies for her arts and crafts business. Hillary cashes an $8,000 personal check at a financial institution on a Monday. She subsequently cashes another $8,000 personal check at the bank the following day. Hillary is careful to have cashed the two checks on different days and structured the transactions in an attempt to evade the CTR reporting requirement. Hillary should have made irregular deposits on staggered days covering a significant period of time. Or better, yet she should convert her soon worthless cash to precious metals.

3. A married couple, Bill and Hillary, sell a vehicle for $12,000 in cash. To evade the CTR reporting requirement, Bill and Hillary structure their transactions using different accounts. Bill deposits $8,000 of that money into his and Hillary’s joint account in the morning. Later that day, Hillary deposits $1,500 into the joint account, then $2,500 into her sister’s account, which is later transferred to Bill and Hillary’s joint account at the same bank. Again, Bill and Hillary should have used multiple banks.

The aggregate total of the three transactions totals more than the $10,000 threshold, therefore, a SAR would be filed by the bank and you would be the subject of a federal investigation as all three of the above cases clearly violate the federal banking laws related to structuring. It is a federal crime to break up transactions into smaller amounts for the purpose of evading the CTR reporting requirement. In these instances, the bank is required to file a SAR which serves to notify the federal government of an individual’s attempt to structure deposits or withdrawals by circumventing the $10,000 reporting requirement.

Structuring transactions to prevent a CTR from being reported can result in imprisonment for not more than five years and/or a fine of up to $250,000. If structuring involves more than $100,000 in a twelve month period or is performed while violating another law of the federal government, the penalty is doubled. This is what former Speaker of the House, Dennnis Hastert is facing.

Enforcement

Much like the enforcement of our tax laws, the federal government’s enforcement of its banking laws as it relates to CTR’s, SAR’s and subsequent structuring is quite draconian. Civilian asset forfeiture laws come into play. The government can seize your bank accounts while it determines if a crime has been committed. The government can literally seize your assets in perpetuity without an order of the court. Of course, you could try and sue but you will be up against the deep pockets of the federal government and the case could take years. By the time your case is decided, the financial banking crisis that you are so desperately trying to avoid by withdrawing your money, could be over. So, proceed with caution.

If you ever become the target of a federal investigation, do not, under any circumstances, allow yourself to be interviewed by federal officials without an attorney present and make sure you have the interview videotaped.

In many cases, people go to jail and pay huge fines, not because they have committed a federal crime, but because federal officials state that they have lied or misled them. And if you do not have an attorney present, it is your word versus the federal government. This is how the federal government sent Martha Stewart to prison and Hastert is awaiting final sentencing.

What to Do

The best way to avoid getting your money caught in the bank in the midst of a bank run would be to not let the lion’s share of your money ever cross the bank. Do not allow your employer to direct deposit your check to the bank. Keep some cash at home by taking out a large portion of the money you receive from your employer. Don’t put cash in a safety box because the courts have also ruled that the banks own your safety boxes.

Use electronic transfers to buy into a mutual funds and also use checks to buy silver coins.

Withdraw much smaller amounts until the sum total of your accounts is greatly diminished and is in your possession. Even though the banks “talk” to each other, if the withdrawals are irregular, it is hard to track and substantiate a pattern in court. To open the accounts, simply write a personal check from your home bank. Of course, in these cases, the bank could hold the check for 15-30 days.

Use checks and cash to pay all of your debts. Your want to lower your debt load while unloading your soon to be worthless cash.

Prepay your taxes and some other obligations with checks. Make sure you only pay safe entities. Your local government is not going to disappear, even in a depression. Therefore, you can prepay property taxes. Should you lose the ability to pay your property tax, the government will seize your property for nonpayment.

There will be a post-collapse America, therefore, purchase gold and silver. Gold and silver will be accepted mediums of exchange. Write checks to purchase gold and silver. However, collect the actual silver and gold because if you cannot touch it, you do not own it!

DO IT NOW! BUY PRECIOUS METALS, FOOD, WATER, GUNS, AND MEDICINE

THE RADICAL LEFT WILL COLLAPSE THE ECONOMY AND BRING DOWN THE TRUMP ADMINISTRATION

Donate to The Common Sense Show

In large part, The Common Sense Show is listener/reader supported, we thank you for your kind donations which enables us to carry out our research, reporting and broadcast efforts.

This is the absolute best in food storage. Dave Hodges is a satisfied customer. Don’t wait until it is too late. Click Here for more information.

Whew! That’s a relief, if Dave Hodges is reporting this news, it can’t be true. What a relief.

Already done.

Could probably even give you my bank account details if you’d like, you won’t be able to do anything with it though, except deposit some money, possibly.

Only problem is, I forgot the bank account password.

Why bother?

If the banks go down like that you’re going to be paying $100 for bread and $200 a gallon for gas.

Pull your cash out of the banks! For toilet paper!

Also, like above stated, Dave reported it, so its garbage crap that will never happen.

Our money SHOULD be printed with the statements ; (instead of “In GOD We Trust”) “IN THIEVES And WEASLES We Trust” !!! And “If They CAN Steal It They WILL Steal It And EVERY Last Red Cent Of It” !!! THAT would be TRUTH in advertising if every there were !!!!

Didn’t you say this last year a couple of times?

Ohh again,,

how many times have i heard this b-s,,,totally b-s,,

Lets hope anybody that has any….loses it all…I can’t wait to see some homeless coward white amerifrauds…..Yea!!! Hurry up and wipe those thieving scumb out…yea:)

To all, I wrote the this in detail over a year ago. Perhaps things will change with Trump but remember the Federal Reserve is not a government agency. Unless measures are taken by Trump to protect your money it will be stolen. Dave has a negative opinion about everything, like the sky is. falling but if the banks fail because 70% of the loans they carry are indefault they will take your money. They will go down due to either bonds or derivitives this is a certainty. Laws a have already been signed by Obama that says as soon as you deposit your money it becomes an asset of the bank. I. Suggested everyone withdraw everything. If you have a retirement account look into an IRA LLC where you can convert your retirement account into gold and silver with no penalty and buy the metals anyplace you want and keep it in your possession. Also keep in mind that the FDIC has like 50 billion in reserve to cover like 1 trillion in deposits and they have up to 2 years to pay. Then it’s just a matter of if you will get anything or their reserves will be divided amount depositors. Be safe if you want info on the IRA LLC contact me and I will send you my article. I this particular price he’s not crying wolf. The wolf is at the door. Protect yourself. [email protected]

Protect your future.

Are Ides of March like Jews?