| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

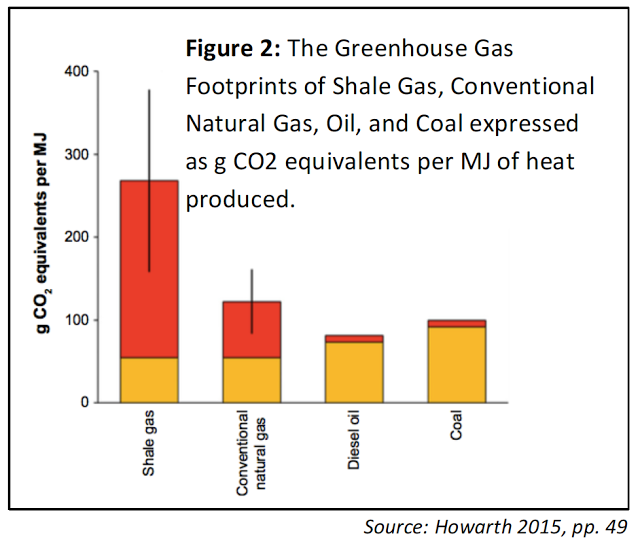

Fracked natural gas is dirtier than coal? Yes.

Read aguanomics http://www.aguanomics.com/ for the world’s best analysis of the politics and economics of water Jan, a student in my environmental economics class, expanded on his blog post in his class paper [pdf] on the costs and benefits of hydraulic fracking of shale to free natural gas (aka, methane). The main issue is leakage of natural gas during the production and transportation of gas. This result is driven by the far stronger impact of unburned (compared to burned) methane on climate change and the high cost of trying to control leaks in the many steps between the well and final user.

This figure tells the story:

Cornelia used to work for Alberta’s oil/gas regulator so she was familiar with this situation (she told me about it years ago). In these guidelines [pdf backup], you can read how industry is only required to control leaks etc. when they are “losing” more than C$55,000 per year in value based on the market price of the gas and cost of capturing it.

Given that 1,000 cubic feet (MCF) of natural gas weighs 62 pounds and 1 MCF sells for about US$4 (C$5 or so), the simplest rule would be to, for example, close an open valve (cost = $0) that’s leaking more than 11,000 MCF per year as that’s worth about C$55,000.

That decision makes sense from a company perspective, but it doesn’t from a social perspective, as the GHG impact of 1 MCF is the same as 0.7 tons of CO2, which has the equivalent “social cost” of about 0.7 tons * $36/ton, or $25.

Going back to that “open valve”, we’re talking about a leak that would have a social cost of $277,000 (C$370,000), which is nearly 7 times higher than its market (lost opportunity to sell) cost. Alberta’s regulator, in other words, is allowing far more leakage and venting based on private costs and benefits than it would if it used social actual costs and benefits.

This result doesn’t surprise me, since the regulator works for industry, but it should help you see how mismanaged the natural gas industry is. (Don’t even get me started about “voluntary data reporting” etc.!)

Bottom line: Years ago I suggested that the natural gas/fracking industry should “take the high road” to setting tough regulatory and performance standards as that would allow them to make greater profits and keep the public on their side. They have failed to do this in a rush to make profits… and hasten climate change.

Source: http://www.aguanomics.com/2017/04/fracked-natural-gas-is-dirtier-than.html