| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

The Gushers Haven’t Dried Up Just Yet… Here’s The Number One Way To Play Oil

This post The Gushers Haven’t Dried Up Just Yet… Here’s The Number One Way To Play Oil appeared first on Daily Reckoning.

This month, Saudi Arabia sent oil prices lower by announcing an increase in production.

Oil prices dropped below $50 per barrel on the news. Since the initial pullback following Saudi Arabia’s announcement, WTI crude oil has been trading in a range of about $48 to $50.

Here’s why this is so important…

Source: TradeStation

As you probably know, Saudi Arabia has been trying to manipulate the oil market since mid-2014.

Originally, Saudi Arabia purposefully sent oil prices into a death spiral in an attempt to put U.S. shale oil companies out of business. The idea was to push oil so low that U.S. companies couldn’t compete. And this would allow the Saudis and OPEC to corner the oil market.

It didn’t exactly work out that way.

What happened instead is that U.S. shale drillers got innovative. And that innovation allowed them to drill wells more cheaply.

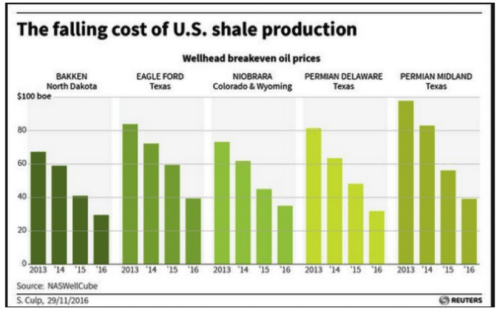

Over the past year, the cost of shale fracking has steadily declined. Today, U.S. companies enjoy a very low “breakeven cost” when drilling for oil in the largest shale formations in the U.S..

Check out the chart below to see how these costs have declined over the past three years.

Source: WSJ’s Daily Shot

So instead of putting the U.S. oil industry out of business, Saudi Arabia essentially gave U.S. oil companies the incentive to become more innovative, more efficient, and to produce oil at cheaper prices.

That’s great news for the U.S. shale oil industry!

Saudi Arabia Captures Headlines With Another Weak Move

Last month, Saudi Arabia increased oil production by 2.7% to 10.011 million barrels per day.[1]

By increasing production in February, Saudi Arabia was boosting the supply of oil on the global market. We know from Economics 101 that the more supply of a commodity, the lower the price.

The financial media loves to tout how Saudi Arabia is the second largest global oil producer. Only Russia produces more oil than Saudi Arabia.[2] So when Saudi Arabia increases production, the talking heads on CNBC and Bloomberg Television make a big deal about it.

But the bottom line is that Saudi Arabia has already tried this move.

In 2014, oil was trading near $120 per barrel. Ramping up production had a big effect on the global price of oil. But today, Oil is trading at less than half of that level. So I don’t expect oil to move much lower than its current range.

More importantly, U.S. oil companies are not nearly as vulnerable as they were two years ago. The chart above shows you how cheaply these companies can produce oil and still turn a profit. Plus, the weakest oil companies have already been shut down or acquired during the 2014 / 2015 bear market for oil.

The U.S. oil companies that are left represent the strongest and most resilient operations. Which means Saudi Arabia is very unlikely to capture much market share by boosting production.

After all, Saudi Arabia can’t live forever with low oil prices…

The country has bills to pay. It’s burning through cash at an alarming rate. And if oil prices remain below $50 for an extended period of time, Saudi Arabia won’t be able to survive.

That’s why I don’t think Saudi Arabia’s will continue to increase production. And I don’t think this move will have a long-term effect on oil prices.

So if I’m right and the price of oil doesn’t have too far to fall, what’s the best way to take advantage of today’s lower oil market?

Don’t Worry about the Price of Oil, Here’s How You Can Profit…

Investors are going to find some of the safest and most lucrative oil investments not in the stock market, but instead by purchasing corporate bonds.

How do I know?

Because I’ve already shown investors how to lock in tremendous profits from energy-related corporate bonds.

Investing in oil-related bonds is very different from investing in oil-related stocks.

Yes, they’re both affected by the price of a barrel of oil.

But stock investors live and die based on the profits that each oil company generates. More accurately, stocks move higher and lower based on what investors expect profits to be. And you and I both know that traditional investors can be fickle animals.

Oil stocks in general are more speculative and can have more risk.

Corporate bonds, on the other hand, come with a company guarantee. by law, oil companies are required to pay semi-annual coupons to their investors. And when the bonds mature, the company must pay you $1,000 for every bond you own.

That legal requirement is why bonds can be much safer — and much more lucrative investments for energy investors. Especially if you pick your bonds up during a down market.

Case in point:

In April of 2016, when oil was trading near $45 per barrel, I recommended buying the bonds of EP Energy – a U.S. oil producer. Since investors were worried that lower oil prices would hurt energy companies, we were able to buy these bonds at 51-cents on the dollar.

That means every $1,000 bond only cost us about $510.

Fast forward to today, and those bonds are trading closer to 90-cents on the dollar. Meanwhile, each bond has paid us $93.75 of income as well.

EP Energy bonds aren’t the only bonds we’ve been able to do this with. We’ve made similar plays with Clayton Williams, Resolute Energy, Bill Barrett and other oil producers as well.

The key to making money from energy corporate bonds is to buy these income investments in a down market for oil. This way, you’re more likely to pick up the bonds at a discount.

Then, you can sit back and collect your income payments, knowing that both your income and the investment value of your bond is protected by a legal guarantee. As long as the energy company stays in business, they’re legally required to pay you!

Researching New Opportunities in a Down Oil Market

I’m keeping a close eye on the oil market, and on the moves that Saudi Arabia is making to manipulate oil prices. My guess is that over time, Saudi Arabia will be unable to affect oil prices as much as they have been able to in the past. That’s because U.S. oil production is picking up, and capturing a bigger chunk of the global oil market.

Once it’s clear that oil prices are firming, we’ll be hoisting the buy flag on other resource based opportunities.

Here’s to growing and protecting your wealth!

Zach Scheidt

Editor, The Daily Edge

[email protected]

The post The Gushers Haven’t Dried Up Just Yet… Here’s The Number One Way To Play Oil appeared first on Daily Reckoning.

This story originally appeared in the Daily Reckoning

Source: https://dailyreckoning.com/gushers-havent-dried-just-yet-heres-number-one-way-play-oil/