| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Three bottom spotting techniques for traders

Wednesday, March 22, 2017 14:23

% of readers think this story is Fact. Add your two cents.

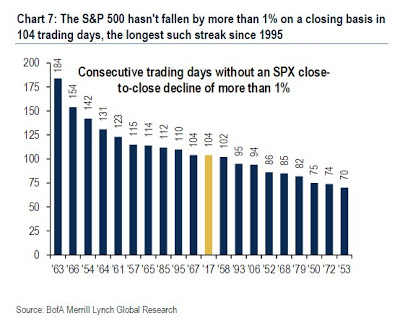

Mid-week market update: Regular readers will know that I have been tactically cautious on the market for several weeks, but can the blogosphere please stop now with details of how many days it has been without a 1% decline?

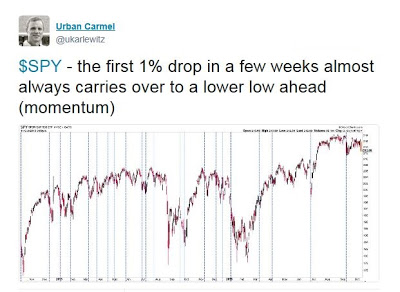

The market fell -1.2% on Tuesday with no obvious catalyst. Despite today’s weak rally attempt, Urban Carmel pointed out that the market normally sees downside follow-through after 1% declines after calm periods.

Within that context, I offer the following three approaches to spotting a possible market bottom, with no preconceived notions about either the length or depth of the correction.

The full post can be found at our new site here.

Source: http://humblestudentofthemarkets.blogspot.com/2017/03/three-bottom-spotting-techniques-for.html