| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Weak Bounce Wednesday – B-B-B-Brexit Baby!

Oh baby you know what I likeChantilly lace and a pretty face

And a pony tail a hangin' down

That wiggle in the walk

And giggle in the talk

Makes the world go round

There ain't nothin' in the world

Like a big eyed girl

That makes me act so funny

Make me spend my money

Well Brexit is official as the UK finally sent it's breakup letter to the EU (not a text, mind you, the UK is classy that way) and now there is a definitive 2-year countdown clock before they officially divorce – unless they decide to extend it – then it could be longer. Makes you kind of wonder what all the panic was about. It's like when your parents get divorced but keep living in the same house.

The markets continue to be divorced from reality as we watch the S&P run a textbook 5% Rule™ correction as it falls 2.5% to 2,340 from 2,400 and that's a 60-point drop so our fabulous 5% Rule™ predicts a 20% weak bounce (12-points) to 2,352 and a 40% strong bounce to 2,364 which, no coincidentally at all, happens to be the 50-day moving average on the S&P.

The markets continue to be divorced from reality as we watch the S&P run a textbook 5% Rule™ correction as it falls 2.5% to 2,340 from 2,400 and that's a 60-point drop so our fabulous 5% Rule™ predicts a 20% weak bounce (12-points) to 2,352 and a 40% strong bounce to 2,364 which, no coincidentally at all, happens to be the 50-day moving average on the S&P.

Of course we are shorting at the 50 dma. I put a note out to our Members this morning in our Live Chat Room, saying:

/YM testing 20,600 from above – off a bit from yesterday's close. /ES 2,350, /NQ 5,406 and /TF 1,361 – all off their highs and we can play the laggards below those lines (5,400 on /NQ and 1,360 on /TF).

As noted above, these are just the weak bounce lines we expected to get to (and fail) after last week's sell-off so, if we're breaking down here – it's a good sign to short the indexes again.

The markets bounced back yesterday mainly on reports of higher Consumer and Investor Confidence but the reports were for February and this is March and a lot has happened since February, particularly the failure of TrumpDon'tCare to pass which, in turn, imperils the proposed tax cuts and infrastructre (because we can't make the poor people pay for it).

The markets bounced back yesterday mainly on reports of higher Consumer and Investor Confidence but the reports were for February and this is March and a lot has happened since February, particularly the failure of TrumpDon'tCare to pass which, in turn, imperils the proposed tax cuts and infrastructre (because we can't make the poor people pay for it).

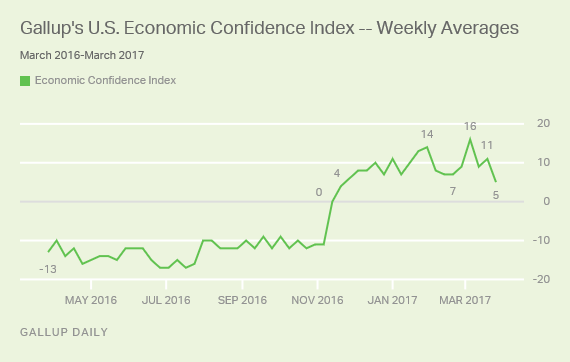

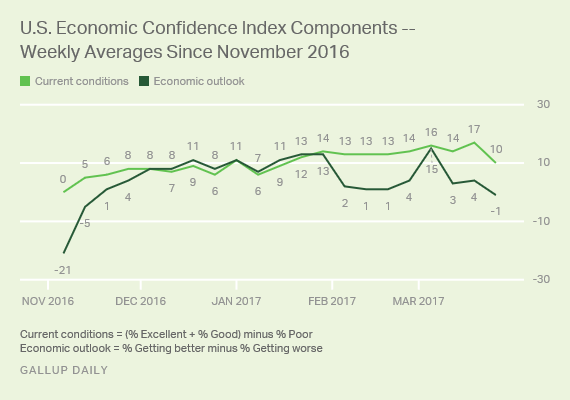

As I said when interviewed at the Nasdaq open on Monday, the political turmoil will lead to a very sharp correction in Consumer Confidence and the up-to-date Gallup Poll show's Economic Confidence hitting lows for the year after topping out in February, which is the late reports the markets decided to celebrate yesterday. I'm not the only analyst with a calculator – this will lead to another sell-off for sure.

Also, as with all these polls, keep in mind that only 32% of the American people are rating the economy “excellent” or “good” and 1/3 of those people are in the Top 10% and 2/3 are in the Top 20% and, for the Bottom 80%, 90% of them think the economy SUCKS!!! It's been 67 days and this country is NOT great yet – let's get a move on people! In fact, despite Trump's crushing election victory, 47% of the voters think the economy is “getting worse” compared to 46% who think it's getting better (hence the -1 reading on outlook). Actually, that was the vote margin, wasn't it?

Also, as with all these polls, keep in mind that only 32% of the American people are rating the economy “excellent” or “good” and 1/3 of those people are in the Top 10% and 2/3 are in the Top 20% and, for the Bottom 80%, 90% of them think the economy SUCKS!!! It's been 67 days and this country is NOT great yet – let's get a move on people! In fact, despite Trump's crushing election victory, 47% of the voters think the economy is “getting worse” compared to 46% who think it's getting better (hence the -1 reading on outlook). Actually, that was the vote margin, wasn't it?

If consumers are not confident they don't….. anyone?…. consume! See, that was an easy one! Now, a loss of consumer confidence leads to stronger or weaker corporate sales? That's right – see, these are not brain-teasers… With Q1 earnings coming up which include or exclude March? That's right again – you are really good at this! So if March is included and Consumer Confidence is crashing will earnings be better or worse than expected? See, market forecasting is easy!

If you want to know how to short the market, we did an extensive review of our early March trades (because we don't need no stinkin' survey to tell us conditions are worsening) last Thursday and some of those 11 are still playable and, since the 15th (last day reviewed), we added the following trade ideas in our Morning Reports:

March 16th: We made a general call to short the Index Futures and explained our technique:

- Dow (/YM) short at 21,000, now 20,600 - up $2,000 per contract

- S&P (/ES) short at 2,390, now 2,350 - up $2,000 per contract

- Nasdaq (/NQ) short at 5,440, now 4,410 - up $600 per contract

- Russell (/TF) short at 1,390, now 1,365 - up $3,500 per contract

We referred back to our SQQQ and TZA option hedges from the 15th (both winners, of course) and we also had a bullish play on SPY but I wouldn't call it a recommendation – it was just an example of how easily we could make 435% on $5,600 ($24,600) if we were wrong and the Futures broke over our levels. So far, there has been no need for that play! As I said at the time “Until then, we're more comfortable shorting this silliness.“

March 17th: Here's one that's playable again. We thought $850 was silly on Amazon (AMZN), so we put a short play on them. It looks like it's still playable as AMZN popped back to $856 for a $6 loss (0.7%) at the moment. Though we discussed the idea for the trade – it was not disclosed in the morning report – only for our live Chat Members (sorry). We also called the bottom on Target (TGT) and Wal-Mart (WMT) but no specific options plays.

March 20th: We called for a short on Oil Futures (/CL) at $49.50 and we're at $48.50 this morning for a gain of $1,000 per contract. The review of the Chevy Bolt led us to put on a specific short on Tesla (TSLA) as follows:

We're hoping TSLA goes higher but worried they won't so our trade for the moment is going to be:

- Sell 3 TSLA April $265 calls for $9 ($2,700)

- Buy 5 TSLA April $290 puts for $30 ($15,000)

- Sell 5 TSLA April $275 puts for $19 ($9,500)

That nets you into the $7,500 spread for $3,300 so the upside potential is only $4,200 (127%) but, on the bright side, it's only 32 days away (April 21st) to expiration. We only need TSLA to stay below $265 to collect the money and, if they go higher, we will roll our short calls to 6 May or June calls at higher strikes (the June $305 calls are $5 and the margin is $15,000 on 6 short ones) and then we would widen the spread, possibly adding $5 or less to roll our $290 puts to the $300 puts (now $38.50).

So we'll take the spread as we'd hate for it to get away but we're actually HOPING (not a valid investing strategy) that Tesla goes a bit higher first – so we can get better prices for a bigger spread.

We did, in fact, get the boost and got better entries in our Live Member Chat Room but, going with what we published in the morning Report: The $265 calls are $17 ($5,100) and the $290/275 spread is now net $4,550 for a net -$550, which is down $3,850 (116%) with TSLA at $277.50 though, if this is where they expire, the spread will ultimately be a winner. Needless to say – I still like the spread, possibly more so with the net $550 credit on the $12,500 potential upside.

March 21st: Our trade idea for the day was buying the Biotech Index (IBB) Sept $250 puts for $4.50 and those are now $5.50, which is up 22% but we did hit our 33% goal ($6) so shame on you if you didn't cash out at full profits! There's also a Freeport McMoRan (FCX) trade idea in that post that is still good as a new trade.

March 22nd: The TSLA trade was up $1,980 (60%) that day and got better so note the above is for people who were too greedy to take a nice profit when they get it! For a new hedge, we suggested the S&P Ultra-Short (SDS) using the following combo:

- Buy 30 SDS June $12 calls for $1.70 ($5,100 – instructions for rolling were included)

- Sell 3 TGT 2019 $45 puts for $4.20 ($1,260)

- Sell 5 TASR 2019 $20 puts for $2.90 ($1,450)

- Sell 2 GILD 2019 $55 puts for $5 ($1,000)

The SDS calls have actually fallen to $1.60 ($4,800) because it's down, but not fast enough to outrun the premium decay of the long calls. The TGT puts are $4.10 ($1,230), the TASR puts are $2.75 ($1,375) and the GILD puts are still $5 ($1,000) so net $1,195 is down $45 at the moment – still good for a new hedge.

We also called for longs on the Gasoline Futures (/RB) at $1.60, now $1.65 - up $2,100 per contract. That makes up for the $45, right?

March 23rd: I reiterated the Index Puts, albeit from a slightly lower level so I won't count those twice. Other than that, we just did our review of the 1st-15th trades, where we had 10 winners out of 11 ideas (91%) in the first half of the month for $19,684 in total profits.

March 24th: I said we had a huge, long position on AAPL ($140 that morning) but no specific trade. Our favorite long was the Dollar at 99.50 and it had a rough ride but 99.85 at the moment is back on track for a $350 per contract gain but plenty of room to run there.

That was Friday so no sense in reviewing Monday on Wednesday and we'll do another review of our Free Sample Picks in April (when its over). In the next 7 sessions we put up another 11 trade ideas but, unfortunately, 3 are not yet winners (27%) which destroys our average for the month as we now only have 18 out of 22 winners for an 82% winning percentage. That's only a B!

Bs are not acceptable at PSW but, fortunately, we know how to fix trades so we will revisit these trades in April and we will try to fix those losers – it will be a good lesson on making adjustments anyway…

Bs are not acceptable at PSW but, fortunately, we know how to fix trades so we will revisit these trades in April and we will try to fix those losers – it will be a good lesson on making adjustments anyway…

It's the perfect time to grab SDS, TSLA or AMZN if you didn't like the way your portfolio behaved on the recent dip. There's nothing like a good hedge to get your through those rough market days!

Be careful out there.

Provided courtesy of Phil’s Stock World.

Would you like to read up-to-date articles on the day they are posted? Click here to become a part of our growing community and learn how to stop gambling with your investments. We will teach you to BE THE HOUSE – Not the Gambler!

Source: http://www.philstockworld.com/2017/03/29/weak-bounce-wednesday-b-b-b-brexit-baby/?utm_source=beforeitsnews&utm_medium=feed&utm_campaign=psw-feeds&utm_content=article-link