| Visitors Now: | |

| Total Visits: | |

| Total Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

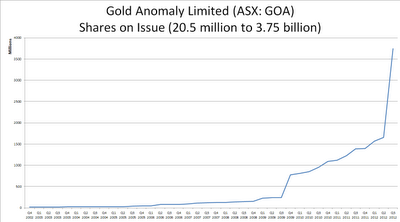

Resource Companies Print Shares Like Bernanke!

Here is a weekly chart of the share price over the last decade:

|

| CLICK CHART TO ENLARGE |

Juniors have been making big mistakes too

This failure to read the gold market extends across the junior sector too. From 2001 to 2007, it was easy to raise money. Exploration companies would issue shares, raise capital, go out and drill, hopefully declare something half decent, then go and raise some more money at a higher price.

Then we got the credit crunch, and funding dried up. Yet so many companies are still trying to follow this broken business model. They have been decimated this year. The only ones that have done well in 2011 are those that have mined metal at a low price, and sold it at a higher one. It really isn’t rocket science. That’s what gold miners are supposed to do. But often they don’t.

I have long railed about this. The gold price is high, and the credit markets are dead. Gold won’t be this high forever – so mine the easy-to-get stuff and sell it while you can. Forget expanding the resource, or doing anything else – just get mining. This market isn’t interested in blue-sky stuff – it isn’t interested in dreams, it wants hard cash. Money Week

It’s not only explorers which can be hit by these problems. Even producers with high cash costs (cash cost may be below spot price, but administration, development and exploration costs soak up profit and require the company to continue raising capital) can experience similar issues. Apex Minerals (AXM) is a marginal Gold producer that comes to mind and has been hit hard over recent years. Trading well over $1 in 2008 they fell to less than 1c and then earlier this year had a 100:1 consolidation following which the share price continued to fall. Such consolidations often hide the true extent to which a company has been allowed to print shares in order to continue trading.

Hedge fund boss John Paulson has often made the conventional wisdom case for owning gold shares – that mining companies enjoy superior leverage to gold prices, perhaps rising as much as 2-3 times as much as the gold price. As noted recently in the Wall Street Journal, he’s backed up his thesis with big slugs of gold equities.

Color us skeptical.

We mean no disrespect to the likes of Paulson. But the case for equity leverage to gold is diminishing and will continue to do so until mining company executives and their bankers stop the addiction to deal-making. Until then, non-insider investors in precious metal equities will continue to bear the brunt of the penchant for financial engineering that is based on a permissive attitude to the stock register.

We’re not naive about the temptations and opportunities for stuffing scrip down the market’s throat. When you own a money printing press you tend to use it, especially when your performance is incentivized primarily through near-term movements in stock prices.

Yet who cannot be galled to hear precious metal miners cooing and tut-tutting about profligate central bankers and leveraged sovereigns even as they issue stock at rates to make even Ben Bernanke blush, make high risk bets on the far distant future, and spend more on fees and commissions than dividends. Mine Fund

The good thing about holding physical is that while it’s not without its risks, you have a much greater level of control over that risk (for example you can secure your physical in a safety deposit box facility). Holding physical you are not at the mercy of central bankers or resource companies (who can evidently be as bad, if not worse) who can print their scrip at will.

2012-10-21 07:42:06

Source: http://www.bullionbaron.com/2012/10/resource-companies-print-shares-like.html

Source: