| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

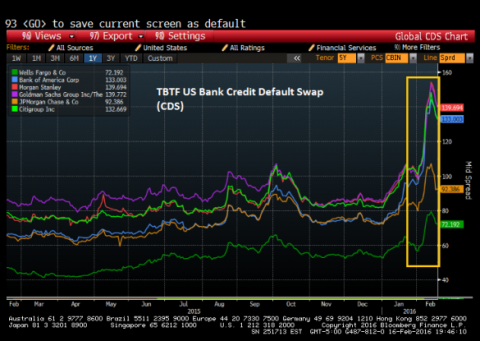

Fed’s Kashkari Floats Breaking Up Big Banks to Avert Meltdown (TBTF Banks Are Already Shrinking!)

Be prepared for the next great transfer of wealth. Buy physical silver and storable food.

wallstreetexaminer.com / by Anthony B. Sanders •

“The biggest banks are still too big to fail and continue to pose a significant risk to our economy,” Kashkari, who managed the U.S. Treasury’s $700 billion Troubled Asset Relief Program for rescuing banks in the 2008 crisis, said Tuesday in Washington. It was his first public speech since joining the central bank on Jan. 1 as its newest policy maker.

While Kashkari’s position fits with populist sentiment that has driven the rise of presidential candidates including Democrat Bernie Sanders, it’s at odds with top Fed leaders including Chair Janet Yellen, who isn’t calling for dramatic steps such as breaking up large banks. Such changes would also face a steep uphill battle to adoption by the Republican majority in Congress, which wants to roll back parts of the Dodd-Frank financial law passed in 2010, rather than go further as Kashkari proposes.

The post Fed’s Kashkari Floats Breaking Up Big Banks to Avert Meltdown (TBTF Banks Are Already Shrinking!) appeared first on Silver For The People.

Thanks to BrotherJohnF

Source: http://silveristhenew.com/2016/02/17/feds-kashkari-floats-breaking-up-big-banks-to-avert-meltdown-tbtf-banks-are-already-shrinking/