| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

DOW Closed above 21,000 for the first time, What’s Next

Dear PGM Capital Blog readers,

On Wednesday, March 01, 2017, the DOW industrial Index, soared 300 points to close above 21,000 points for the first time.

Other USA major indexes posting also their best day of the year, on the back of President Donald Trump’s first address to the Congress.

Trump’s speech to Congress was judged by both sides of the political divide as his most “presidential” moment, at least in tone.

DOW JONES INDUSTRIAL SURGED ABOVE 21000 POINTS:

This milestone comes barely a month after the DOW has hit 20,000 on January 25, 2017, which means that it took the DOW only 24 trading days to go from 20,000 to 21,000. That ties a record set in 1999 for the shortest period between 1000-point milestones, of course, that late 1990s rally took place from lower levels, making it more impressive on a percentage basis. It also occurred during what turned out to be the height of the dotcom bubble that imploded soon afterwards.

Bank stocks have been among the biggest winners Wednesday as the S&P financial sector rose to its highest level since the Great Recession which began in December 2007 and ended in June 2009. f

Shares of Goldman Sachs, (NYSE: GS) were the biggest winner, last Wednesday and due to this contributing the the most gains of the 300 increase, that brought the DOW Jones Industrial above the 21,000 point milestone.

As can be seen from below 1-year chart since the election of the Trump, the shares of the company has surged with approx. 44 percent.

PGM CAPITAL COMMENTS & ANALYSIS:

Everyone is looking to Trump – who noted the market had added US$3 trillion in value since his election during the congressional address – as the stock market’s chief motivator.

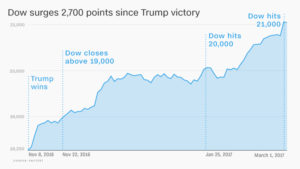

As can be seen from below chart the DOW surged more that 2700 points. since Trump’s victory of November 8, 2016.

For apolitical bulls, the first thing to remember is that the market has been rising for a year now, not just since the election.

Highlights of the USA Markets in 2016:

- February 2016 marked the bottom of a market panic over China, and fears of a new European recession, that pushed the S&P 500 down 15 percent since June 2015.

- Then it rose 16 percent before Trump’s election on Nov. 8.

- See below chart of the DOW from January 1 – December 31, 2016 for details.

Currently investor sentiment has not been this high since 1987 – two market bubbles ago -, which brings up the most apolitical reason to be skeptical of the current rally,

Reasons to be worried:

- USA stocks are trading at 18.4 times this year’s projected profits, and the market is defying a past pattern of going through at least one 5 percent correction between each thousand-point milestone on the Dow Jones Industrial Average.

- The Dow made it from 19,000 to 20,000 without a setback, and made it 21,000 on Tuesday also without a correction.

- Valuations are at best fairly valued and at worst overvalued, the bulls justify their forecasts by saying that tax cuts are not currently included in the 10.8 percent projected rise in S&P 500 earnings for 2017.

- We believe that Trump’s tax cuts are more likely to be a 2018 event than something that gets through Congress this year.

- Prospects for valuations are worsened by the rising likelihood that the Federal Reserve will raise interest rates at least twice this year, and maybe three times, since higher rates historically reduce the premium investors will pay for a given level of corporate earnings.

- The likelihood that the Fed raises in March has shot up, doubling this week from 33 percent to 66 percent.

- The USA Consumer Price Index has risen 2.5 percent in the past year, making more investors conclude the Fed’s target for core inflation, which excludes volatile energy and food prices, will soon be reached, which will wiped out all of the 2016 average increase in hourly compensation workers have received.

- US-Dollar Index at almost 13-year high as can be seen from below chart, which will make US product more expensive abroad and will have a negative effect on consolidated earnings from abroad.

- Wall Street is increasingly skeptical that Trump’s plans to boost mostly private-sector infrastructure investment by US$1 trillion over 10 years using tax credits would make it through Congress.

Based on the above, we as a contrarian, are very skeptical and extremely worried that a crash of both the US-Markets as well as the US-Dollar are baked in the cake.

For reasons as mentioned here above, we believe that the high to overvalued US-Dollar is not sustainable in the long run.

Based on this we are advising our clients that mainly have their savings in US-Dollar pegged currencies to use their (indirectly) overvalued US-Dollar to invest in Precious metals and securities of conglomerates and disposable consumer goods manufacturers, with strong balance sheet and low valuation which are trading in under-valued currencies like the AUD, EURO, CAD and GBP.

However investors should keep in mind below quote of John Maynard Keynes:

“Markets can remain irrational for longer than you can remain solvent”

The above also points to a simple fact, You’re dreaming if you think this rally is all about Trump.

Until next week

Yours sincerely

Eric Panneflek

Source: http://www.pgmcapital.com/dow-closed-above-21000-for-the-first-time-whats-next/