| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

The Next Step in ‘Dollars’?

Alhambra Investment Partners: I continue to believe that the Swiss National Bank’s action on January 15 opened a “release valve” of sorts inside the world of the global “dollar.” Prior to that day, heightened bearishness all throughout dollar-denominated credit dominated trading. That included funding markets, especially eurodollars. The eurodollar curve itself ignored almost everything else, including the FOMC switch to “patience” in December, running quite dramatically and contrarily to any idea of an end to ZIRP.

Alhambra Investment Partners: I continue to believe that the Swiss National Bank’s action on January 15 opened a “release valve” of sorts inside the world of the global “dollar.” Prior to that day, heightened bearishness all throughout dollar-denominated credit dominated trading. That included funding markets, especially eurodollars. The eurodollar curve itself ignored almost everything else, including the FOMC switch to “patience” in December, running quite dramatically and contrarily to any idea of an end to ZIRP.

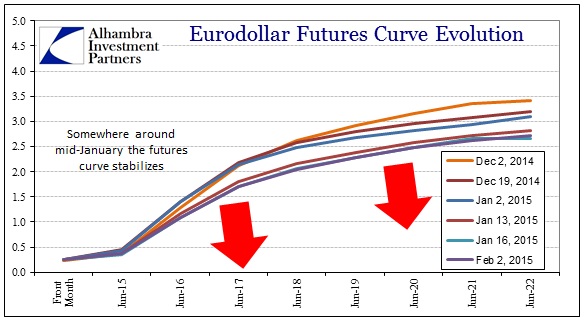

The curve stabilized sometime between January 15 and February 2. Granted, there was a lot that happened in those few weeks so I would not hold it against anyone who viewed the ECB’s QE or even the lack of Greek finality with the new election results as being the primary factor, but I think the timing of a lot of this relates to that Swiss pressure in and out of the “dollar.” After February 2, the eurodollar curve started to act more aligned with mainstream outlook for monetary policy (or what the FOMC wants everyone to believe).

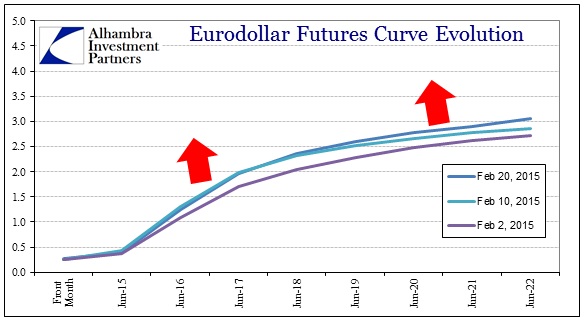

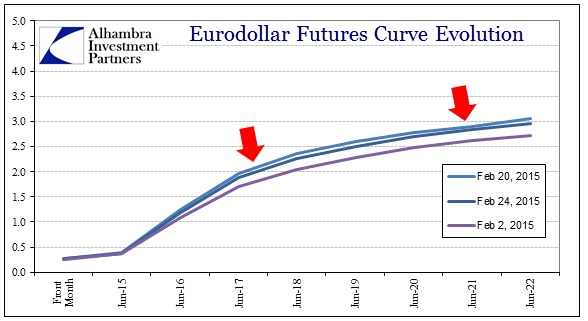

Obviously, there are daily variations in between these generalized moves, but for the most part between the beginning of February and last Friday the eurodollar curve was commonly moving upward. Trading this week so far has seen the largest and most sustained countertrend (once more alike the Dec-mid Jan move). That might suggest an end to the “reprieve” that was offered at least starting with the SNB’s peg removal on January 15.

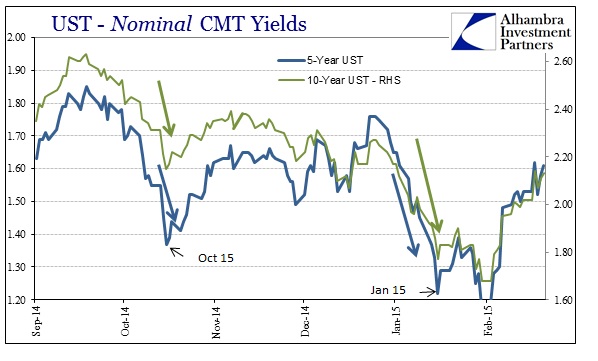

Nominal yields in UST markets would seem to concur. The 10-year rate had seen heavy buying right up into January 15. The yield would go slightly lower to the end of January, but there is little doubt about what looks to be a second period of high illiquidity and frantic, almost panic buying in UST (uncertainty) on par with October 15; all ending with the SNB’s peg removal.

(…)Continue reading the original Market Daily News article: The Next Step in ‘Dollars’?

You are viewing a republication of Market Daily News content. You can find full Market Daily News articles on (www.marketdailynews.com)

Source: http://marketdailynews.com/2015/02/26/the-next-step-in-dollars/