| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

Stocks Continue To Have An Opportunity Cost Advantage

Chris Ciovacco: - Investment A vs. Investment B - Investment capital is always looking for a home. Stocks continue to benefit from easy money policies around the globe. From Reuters:

Chris Ciovacco: - Investment A vs. Investment B - Investment capital is always looking for a home. Stocks continue to benefit from easy money policies around the globe. From Reuters:

“Money is continuing to pour into the (equities) market because of low interest rates, and although stocks are somewhat expensive they’re not overly expensive,” said Stephen Massocca, chief investment officer at Wedbush Equity Management LLC in San Francisco.

Data Says Low Rates May Last

If inflation starts to rear its ugly head, the Federal Reserve will be forced to raise interest rates. Recent data says that does not appear to be an imminent scenario. From The Wall Street Journal:

“The price index for personal consumption expenditures, which is the central bank’s preferred inflation gauge, rose 0.2% in January from a year earlier. That followed annual growth of 0.8% in December, 1.2% in November and 1.4% in October, the Commerce Department said Monday. It was the lowest reading for headline inflation since October 2009, when prices rose just 0.1% from a year earlier following seven months of year-over-year price declines as the 2007-09 recession ended.”

The Big Picture

This week’s stock market video examines the bigger risk-reward picture given last week’s stall in equity prices.

Investment Implications – The Weight Of The Evidence

From a January 30th CCM video clip when the S&P 500 was trading at 1,994:

“We know with this 100% certainty… if we are to go into a three-week correction, a three-month correction, or a three-year devastating, hard-to-recover-from bear market, it is not physically possible for any of those three things to happen until the S&P 500 makes a lower low on a closing basis (below 1988). As you can see, it has not made a lower low…”

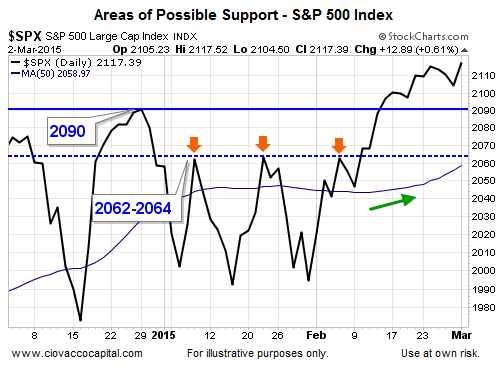

The S&P 500 never closed below 1988; today it sits at 2117, or 123 points above the January 30th close, which illustrates the usefulness of simple support and investment guideposts. Today’s “be patient with our stocks” guideposts include 2090 and 2064.

Join the conversation instantly with Facebook Comments below:

This article is brought to you courtesy of Chris Ciovacco.

You are viewing a republication of Market Daily News content. You can find full Market Daily News articles on (www.marketdailynews.com)

Source: http://marketdailynews.com/2015/03/02/stocks-continue-to-have-an-opportunity-cost-advantage/