| Online: | |

| Visits: | |

| Stories: |

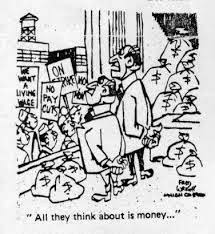

The capitalist class

Tuesday, May 5, 2015 22:27

% of readers think this story is Fact. Add your two cents.

The world’s 25 best paid hedge fund managers earned a combined $11.62bn last year – earnings roughly equivalent to the gross domestic product of Jamaica.- even as the industry suffered from largely mediocre performance and growing criticism from some of its largest investors.

Ken Griffin, the founder of the Chicago-based Citadel hedge fund that recently hired former US Federal Reserve chairman Ben Bernanke as an adviser, came top of the list for 2014, taking home $1.3bn.

James Simons, the septuagenarian mathematician and code breaker whose Renaissance Technologies has been one of the best preforming hedge funds over three decades, came in at number two on the list, earning $1.2bn.

Ray Dalio, founder of Bridgewater, the world’s largest hedge fund by assets, was placed third with earnings of $1.1bn.

Bill Ackman, who has been waging an aggressive battle against the US company Herbalife, was ranked fourth with a $950m pay packet.

Hedge funds typically adopt a fee structure known as “two and 20”, or 2 per cent of all assets under management and 20 per cent of profits. This allows managers to earn large sums regardless of their fund’s performance based on the amounts of assets they manage, as well as taking a fifth of any investment gains they make. The average hedge fund returned about 3 per cent in 2014, 9 per cent in 2013, and 6 per cent in 2012. A small but influential group of public pension funds who have spoken out against the industry’s high costs and lacklustre investment performance in recent years.

In January, Europe’s second-largest public pension fund axed its entire €4bn hedge fund portfolio after it was left disappointed by its cost, complexity and low returns. The fund, Holland’s €156bn Dutch healthcare workers’ pension fund PFZW, took the rare step of directly attacking the high pay of hedge fund managers, criticising “the high remuneration in the hedge fund sector and the often limited concern for society and the environment”. Last year Calpers, the largest US state pension fund, said it was pulling out of its hedge fund investments, arguing that its $4bn portfolio was no longer appropriate for its investment aims.

“I have no country to fight for; my country is the Earth, and I am a citizen of the World.” – Eugene V. Debs

Source: http://mailstrom.blogspot.com/2015/05/the-capitalist-class.html