| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

What's Behind the Fed's Decision to Raise Interest Rates in a Struggling Economy?

Dave Lindorff

Much has been written over the past few weeks in the financial press and the business pages of general interest newspapers debating the wisdom of the decision in December by Janet Yellen and the Federal Reserve Board to raise interest rates for the first time in almost a decade.

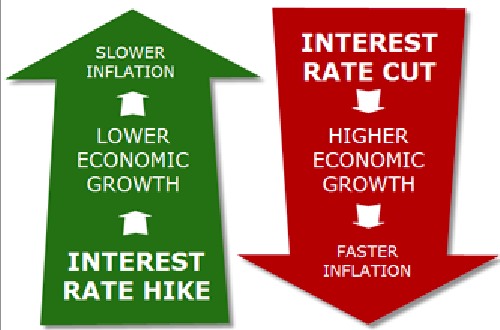

On one side of this debate are people who say that the Fed needs to do this to prevent inflation from taking off. On the other side are people who warn that pushing up interest rates at a time when unemployment is still at a historically high level (and when real unemployment is more than double the official 5% rate) risks making things worse.

The increase of 0.25% in the Federal Reserve's benchmark federal funds rate — the rate banks charge each other for holding short-term funds — is pretty minimal, but the arguments for raising the rate are absurd on their face.

The New York Times quoted Fed Chairwoman Yellen as saying interest rates needed to be pushed up lest the economy begin “overheating”! As she put it, had rates not been raised last month, “”We would likely end up having to tighten policy relatively abruptly to prevent the economy from overheating,” which she said could then throw the US back into recession.

What planet, or more specifically, what national economy does Yellen inhabit?

The US is so far from being an “overheating” economy it's not funny. Official unemployment has remained stalled at 5.1% for three months now, but that is a bogus number created during the Clinton administration when the Labor Department obligingly eliminated longer-term unemployed people who had given up trying to find a job from the tally of the unemployed. The real unemployment rate — called the U-6 rate by the Labor Dept.– which includes discouraged workers who have temporarily stopped trying to find nonexistent jobs, as well as people who are involuntarily working at part-time jobs but who want to return to full-time employment, is actually still above 10%. If people who have simply left the labor market because there is no work for them, the real rate rises to 22.9%.

Anyone who thinks an economy with that much slack in its labor force is in danger of imminent “overheating”, as defined by rising pressures on employee wages and by rising prices from increased demand for goods and services, is nuts.

Raising interest rates in a economy that's still in a funk makes no sense…unless you think the economy's about to tank and you are stuck at a 0% with nowhere to drop rates as a stimulus

Raising interest rates in a economy that's still in a funk makes no sense…unless you think the economy's about to tank and you are stuck at a 0% with nowhere to drop rates as a stimulus

A news collective, founded as a blog in 2004, covering war, politics, environment, economy, culture and all the madness

Source: http://thiscantbehappening.net/node/2987