| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

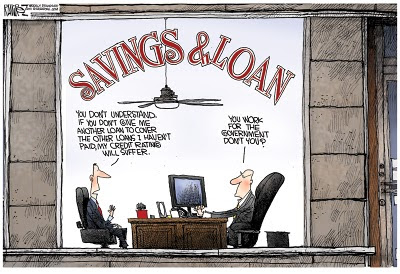

US Savings And Loan Crisis Was Our Version Of Greek Bailout–MYC Bailed Out Mostly Texas Institutions [pictures]

Jared Bernstein weighs in on the big No, hopes that it leads to a change in Europe’s approach, but acknowledges the political difficulties:

To be fair, it’s not that simple. There are structural political factors in play, endemic to the fact that the currency union is not a political union, nor a fiscal union, nor a banking union. As one German economist put it to me, “How do you think the people of Manhattan would like bailing out Texas?” Fair point, and a non-trivial challenge, for sure.

Ahem. As it happens, the people of Manhattan did bail out Texas, big time. I wrote about it here. The savings and loan crisis, which was very costly to taxpayers, was mainly a Texas affair:

The cleanup from that crisis cost taxpayers about $125 billion (pdf), back when that was real money. As best I can tell, around 60 percent of the losses were in Texas (pdf). So that’s around $75 billion in aid — not loans, outright transfer.

Texas GDP was about $300 billion in 1987. So this was equivalent to giving — not lending, not even taking an equity stake — Spain 25 percent of its GDP to bail out its banks.

But of course Manhattan was never asked to bail out Texas; we had a national system of deposit insurance, and the big Lone Star bailout was automatic