| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

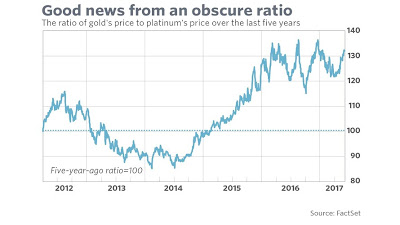

Is the gold/platinum ratio flashing a buy signal for stocks?

Mark Hulbert recently highlighted an equity buy signal from an obscure indicator, the gold/platinum ratio. The signal is based on a research paper by Darien Huang, an academic at Cornell.

The rationale behind the indicator goes something like this. Both gold and platinum are precious metals, which have defensive characteristics during equity bear markets. But platinum has more cyclical characteristics because of its use in the auto industry. A high gold/platinum ratio (as it is today) is indicative of fear in the market, and therefore stocks should be bought. Conversely, a low platinum/gold ratio signals complacency, which is a sell signal.

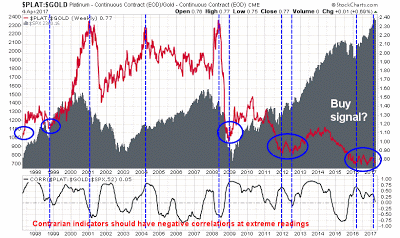

The way to approach cyclical indicators like these is to decide whether an investor should bet with them (momentum indicator), or against them when readings are extreme (contrarian indicator). The chart below shows the platinum/gold ratio (in red) and stock prices (in grey). The bottom panel shows the rolling one-year correlation between the ratio and stock prices.

Based on this chart, I can make a couple of observations. At first glance, this seems to be a reasonably good contrarian indicator at extremes. But given the wide ranges, how can you tell what’s an extreme reading?

One way to determine whether a contrarian indicator works well at extremes is to look at the correlations of the signals to the market. A good contrarian indicator should see negative correlations to the market at the time of buy or sell signals, or soon after buy and sell signals. An analysis of the lower panel indicates that is not the case. In fact, rolling correlations appear too unstable for this ratio to be an effective market timing indicator.

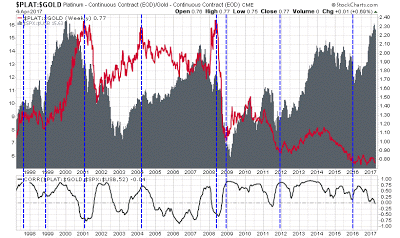

Maybe we are framing the problem incorrectly. Instead of using the SPX to measure the effectiveness of this model, how about using the stock/bond ratio as a measure of risk appetite? The chart below shows the same indicator overlaid on top of the stock/bond ratio. The correlations shown on the bottom panel are better, but they are still very unstable, and correlations were not negative when or after buy and sell signals.

Back to the drawing board? Not quite. There are better ways to measure the real-time strength of the cycle.

The full post can be found at our new site here.

Source: http://humblestudentofthemarkets.blogspot.com/2017/04/is-goldplatinum-ratio-flashing-buy.html