| Online: | |

| Visits: | |

| Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

“Now Hiring!” – In Trump’s America

This post “Now Hiring!” – In Trump’s America appeared first on Daily Reckoning.

President Trump is finally moving the needle.

For proof, look no further than the first week of the last three consecutive months…

On February 1st, the Dow spiked 100 points.

On March 8th, the Dow jumped 20 points.

And On April 5th, the Dow spiked over 180 points.

So what happened on these days? And how is Trump involved?

I’m glad you asked! I’ll reveal that, and how you can profit from it below…

The dates above coincide with the highly anticipated ADP jobs report.

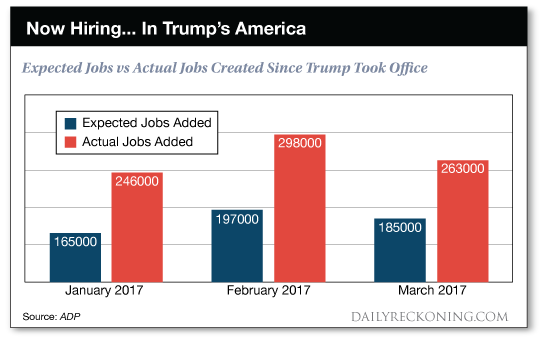

Expectations for job growth vary month by month. However, recently, the number of actual jobs created has blown away expectations. Hence the Dow spiking when the ADP jobs report is announced…

See for yourself below:

A quick look under the hood and it’s no wonder the jobs market is heating up…

Charter Communications to hire 20,000 American workers over 4 years.

Ford will invest $1.2 billion in three Michigan plants… Sending a strong pro-U.S. manufacturing message.

U.S. Steel Could Restore Up to 10,000 Jobs… Signs Trump will keep his Rust Belt promises.

The number Wall Street cares so much about is officially titled “Total Nonfarm Payroll Employment.” Which is economist talk for “jobs added to the economy excluding farm work.”

When broken down, the concept is quite simple: more jobs added means a stronger economic environment, while fewer jobs added indicates a weaker economic environment.

The reasons behind this high level of job creation vary… But a contributing factor is definitely President Trump’s stance on putting Americans back to work.

Going forward on three key issues, President Trump’s policies stand to benefit job creation considerably:

Health Care Reform– Small business have been one of the biggest losers of ObamaCare. Repealing laws requiring small businesses to provide health insurance could free up a lot of capital to be put towards creating jobs.

Repatriation– U.S. corporations are estimated to have $2.6 trillion in offshore “tax havens.” The opportunity to bring this money back to U.S. soil could be a catalyst for huge corporate expansion projects.

Deregulation– Taxes, licensing, FDA laws, insurance, inspections, advertising you name it- the government has over-regulated businesses to the point of suffocation. Many of these regulations consume money and resources that could be better spent on job creating opportunities.

Any and all changes to these issues should help continue the streak of positive job growth, which should boost profits for this ONE company…

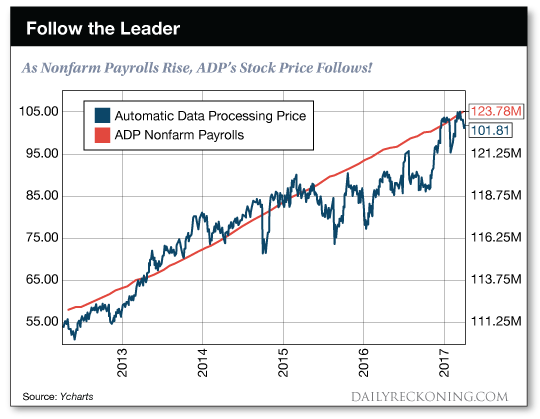

There’s one company whose stock price is highly correlated to the jobs number…

And there’s one company that can benefit from job creation across a variety of industries…

That company is Automatic Data Processing (ADP). Otherwise known as ADP.

This $45 billion company is a third party human resource provider to both small businesses and large corporations. They handle essential human resource functions such as payroll, benefits, retirement, taxes and much more.

ADP gets paid from each customer based on the number of employees they provide services for.

Long story short… With each job created by an ADP customer, ADP increases its revenue with minimal increased costs. And rest assured, ADP has a lot of customers… 650,000 to be exact.

Some of the most notable include Ford, IBM, Marriott, JP Morgan Chase and Microsoft.

To show the correlation between ADP and job creation, just take a look at this chart:

To further evaluate an investment, I stress measuring individual stocks against three pillars of investment success: Capital Preservation, Growth, and Yield. If you are a paid-up Lifetime Income Report reader, you should be very familiar with this strategy.

Here’s how ADP stacks up:

Capital Preservation: Remember when I said ADP currently has 650,000 customers? Here’s the best part: ADP customers stay with the company for an average of 10 years… That makes a steady revenue stream to put investor worries to rest.

Growth: As we talked about earlier, ADP grows when jobs are created. This has led to consistent, high single-digit revenue growth year-over-year… A trend that is likely to continue with President Trump’s Make America Great Again agenda.

Yield: When it comes to yield, ADP is a model of consistency. The company currently pays a 2.25% dividend. But more importantly, for the last 40 years, ADP has consistently increased its dividend every year… This is not a trend that I see breaking anytime soon, especially in this booming job market.

So there you have it… Go long jobs by buying the company that supports them.

I’ll continue to scour the markets for new Trump-era opportunities. This opportunity-laced political environment is bound to shake things up on Wall Street — leading to profits for alert investors.

Here’s to growing and protecting your wealth!

Zach Scheidt

for The Daily Reckoning

The post “Now Hiring!” – In Trump’s America appeared first on Daily Reckoning.

This story originally appeared in the Daily Reckoning

Source: https://dailyreckoning.com/now-hiring-in-trumps-america/