| Online: | |

| Visits: | |

| Stories: |

Iraq’s Oil Industry and Current Economic Outlook

Iraq’s Oil History & Outlook, Part Two

Iraq is destined to become a regional if not global superpower based on the richness of its oil wealth. After all, this young democracy sits atop the world’s second-biggest reserves of high-quality petroleum.

Iraq’s future seems bright indeed. Regardless of the current political squabbling, the oil-fueled Iraqi economy continues to grow rapidly. It’s perennially rated as one of the world’s top ten fastest-growing economies, and there’s plenty of room for additional expansion.

Still, in order to see the clearest view of what the Iraqi economy may look like in five or ten years, it’s helpful to take a look at the history of Iraq’s oil industry as well as new oilfield technologies that are increasing Iraqi production and revenues.

In Part One, we looked at the history of Iraq’s oil-based economy as well as the political and economical developments leading up to the rise of Saddam Hussein and his control of the nation’s economy.

Now let’s take a look at Iraq’s oil industry and current economic outlook, particularly what they mean for the value of the Iraqi Dinar, beginning with the turning point of the coalition invasion in 2003 which ousted Saddam.

The Beginning of the End for Saddam

The U.S.-led invasion and occupation of Iraq quickly ended Saddam Hussein’s ruthless 30-year regime, and it was also the beginning of a new era for Iraq’s long-neglected oil industry.

With Saddam and his cronies gone, the nation soon entered a period of unprecedented economic growth fueled by its booming oil industry.

Once the dust settled after the 2003 invasion, American, European and Middle Eastern oil companies quickly arrived, ready for business. There was much work to be done.

Oil industry infrastructure in the Kurdish region of northern Iraq was relatively unscathed by actual fighting during war.

Still, oilfield equipment and facilities there suffered from years of neglect due to the shortage of replacement parts and new technologies made unavailable by the years of UN-imposed trade embargo and economic sanctions.

In southern and central Iraq, the scene was different: Between the Gulf War of 1991 and the fighting during 2003, approximately 60% of the oil production and refinery facilities in those regions were damaged.

Apart from the impact of economic sanctions and war, Saddam himself stunted the country’s oil industry even further by mandating reservoir-management policies which resulted in lower production for several years after his departure.

Wells were over-pumped, which in some cases permanently reduced their future outflows. And, in an attempt to boost yields lagging because of equipment maintenance issues, the Iraqi engineers reinjected excessive amounts of low-end petroleum fractions back into the ground.

Reinjection is a standard industry technique for increasing a well’s output. However, the Iraqi petroleum engineers reinjected overly-viscous oil constituents back into some wells, which slowed output for several years after Saddam’s departure.

Huge Reserves Compensate for Missteps

Regardless of the mismanagement under Saddam, the fact that Iraq’s overall oil production has soared since his departure illustrates the enormity of Iraq’s reserves and the resiliency of its industry.

In spite of thirty years of bungling, Iraq has been steadily achieving higher oil production totals almost every year since Saddam’s demise.

According to conservative estimates dating to 2001, Iraq is believed to have at least 145 billion barrels of oil remaining to be tapped, and several more-recent estimates have nearly doubled this figure.

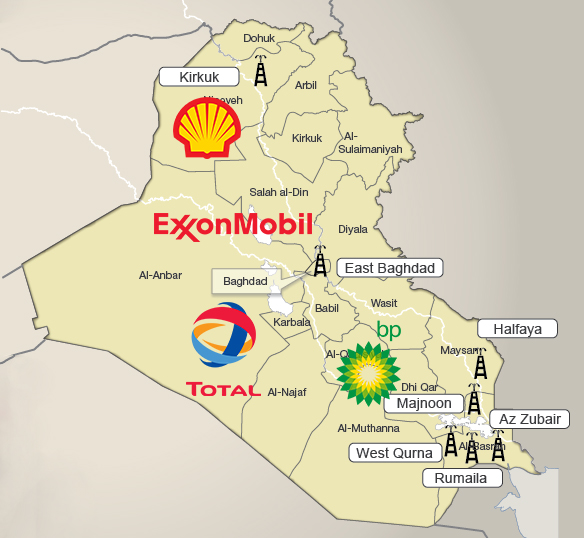

Geographically, most of Iraq’s known petroleum reserves lie in a belt that runs roughly north and south along the eastern side of the country. Iraq has at least 10 fields known to be “super giants” (minimum 5 billion barrels each) and another 25+ “giant” fields (minimum 1 billion barrels each).

Leading petroleum engineers have indicated that southeastern Iraq’s cluster of super-giant fields is the world’s largest concentration of such fields, accounting for about 80% of the country’s reserves. The remaining 20% of known reserves are found in the northern region of Kirkuk, Khanaqin and Mosul.

And, there seems to be plenty of room for more oil discoveries – Iraq is unique because only a tiny fraction of its known reserves are under development, even though it already exports enormous amounts of crude oil. As development continues, more oil gushes forth.

In fact, since 1925 only about 2,200 wells have been drilled throughout Iraq. In comparison, approximately one million wells have already been drilled in the state of Texas alone.

Iraq is also “full of gas.” The country’s proven reserves of natural gas are approximately 115 trillion cubic feet, which is the fifth-largest in the world. About two-thirds of these known gas reserves are located in southern Iraq, and the rest in the north.

Back to work

In any event, as soon as Saddam was gone the Iraqi oil industry began returning to normal. During the years between 2003 and 2008, Iraq was busily repairing both its civilian infrastructure damaged by the war as well as upgrading its long-neglected oilfields.

In 2008 the Iraqi government announced a new plan to work with the world’s largest oil companies – Shell, ExxonMobil, BP and Total, who were the original partners in the Iraq Petroleum Company (IPC) dating back to 1929.

This plan was quickly replaced by an even larger, more comprehensive plan to develop Iraq’s oilfields. In 2009 the Iraqi Ministry of Oil formally awarded service contracts to these original “Big Oil” companies as well as several other international firms including Chevron.

The oilfields under contract for development include Iraq’s “super-giant” fields: Halfaya, Majnoon, West Qurna, and Rumaila. The China National Petroleum Corporation (CNPC) and BP won the contract to develop the Rumaila field, which is Iraq’s largest single field.

As a result of these agreements Iraq was able to increase its production dramatically. By 2009 Iraq had risen from near-zero production at the end of Saddam’s reign to become the world’s twelfth-largest producer.

In 2010 the U.S. government allocated $2 billion to help develop and modernize the Iraqi oil and gas industry, although its direct involvement in managing that industry ended in 2008.

By the end of 2012 Iraqi oil production had risen to nearly 3.5 million barrels per day. Then, in 2014 another milestone was reached: Production averaged 3.6 million barrels per day, a level not achieved since 1979.

In 2014 a brief glitch arose when the Kurdistan Regional Government (KRG) seized control of several northern oilfields in a dispute with the central government in Baghdad regarding revenues.

Fortunately, in early 2015 was at least temporarily resolved, and oil flows have returned to normal since then.

Newer Technologies Boost Iraqi Output

As of 2015, Iraqi oil production is already benefiting from new technologies which had been unavailable during the years of the UN trade embargo.

During the past few years these newer technologies have been introduced into Iraq by the international oil companies that have been using such methods to increase oilfield yields in other countries. Given Iraq’s huge reserves, the nation’s oil industry will certainly to gain the maximum benefit from these technologies.

The most important new technologies are directional drilling and hydraulic fracturing, both of which promise to help boost Iraqi production and exports significantly.

Directional Drilling

Before the 1970s, most wells were drilled vertically. That is, a hole was drilled straight downward until it reached oil, or not.

Then, in 1973 several drilling companies developed techniques for slant drilling, which was an early form of directional drilling that allowed the hole to be drilled at a slight angle.

Directional drilling equipment allows a drill bit to move in a curving line rather than a straight line, so it can snake its way around underground obstacles such as unusually hard rock formations. In fact, given enough depth, wells can be drilled horizontally, that is, parallel to the surface of the land above.

The first practical benefit of directional drilling is that it allows drillers to reach oil reservoirs several miles away from the site of the drilling rig. Current technology allows drillers to drill as far as 6 miles away laterally.

So, for example, directional drilling allows land-based rigs to drill in offshore locations, which significantly reduces production expenses. And, oil located under steep mountains can likewise be tapped from nearby flatlands.

Most importantly in Iraq, directional drilling allows producers to increase the length of underground pipe exposed to the reservoir.

Instead of simply having the very end of the pipe inserted into an oil reservoir, with directional drilling a fairly long perforated section of the pipe is placed in contact with the oil.

This is critically important for ensuring high flows once a well is completed, since oil can be sucked in through a much larger surface area.

In Iraq directional drilling enables producers to overcome the sluggish flows which had resulted from Saddam’s policy of over-drawing oil from wells and then reinjecting thick, undesirable residues back into the ground in hopes of obtaining short-term increases in flow, as mentioned above.

And, directional drilling also makes it possible for multiple wellheads to draw oil from a single drilling site, so the extended length of perforated pipe exposed to the oil in the reservoir means greater yields.

Likewise, directional drilling also allows a single wellhead to draw oil and/or gas from within several different geologic strata (layers of rock) at different depths, something which is impossible with older perpendicular drilling methods.

The introduction of directional drilling technologies has helped Iraq dramatically increase its production, and these technologies hold the promise of even greater yields in the future.

Hydraulic Fracturing

Hydraulic fracturing, sometimes also called fracking, is a method for stimulating wells to produce more oil. The effectiveness of fracking was discovered during a series of experiments in 1947, and the first commercial application came in 1950.

Although some communities in the U.S. have debated the use of fracking for our domestic production, in Iraq the practice is a potential godsend because it may allow oil producers to significantly increase their wells’ outputs.

Water containing a suspension of sand and other constituents is injected under high pressure down into a well in order to create cracks in the oil-bearing rock. These cracks allow oil to flow more freely within the underground reservoir, and therefore more can be extracted.

A hydraulic fracture is created underground by pumping the fracturing fluid into the wellbore in order to increase the underground pressure enough to crack rock. As the rock cracks, the fracturing fluid continues onward, extending the cracking further and further.

Fracking equipment can operate at pressures and flow rates of up to 15,000 pounds of pressure per square inch (psi) with inbound flows of fracking fluid as high as 100 barrels per minute.

Sand and other materials called proppants are added to the fracking fluid in order to “prop open” the cracks already created, so they won’t close while the oil is flowing outward. These propped-open fractures allow oil and gas trapped within rock to more easily flow outward.

It’s been estimated that fracking increases oil production by an average of about 17%, and natural gas production by an average of 45%.

Most importantly, when used together fracking and directional drilling have a synergistic effect – The yields with both together may be substantially higher than if each were used separately.

The Outlook

Given its huge oil reserves and the long-term commitments by international oil companies to develop its oil and gas fields, Iraq is certain to have a bright economic future.

As measured by its ever-increasing volume of oil exports, the country’s oil industry has fully recovered from the damage and mismanagement that it suffered during Saddam Hussein’s reign.

Notwithstanding Iraq’s already-known reserves, it seems likely that recent new exploration efforts by oil companies will lead to an even greater tally of Iraq’s oil wealth.

It’s also important to note that Iraq isn’t just blessed with large reserves, it also happens that the geologic formations holding Iraq’s oil are much more accessible to drilling than they are in most countries, which means the costs of extracting that oil are much lower.

This is significant because Iraq can profitably produce petroleum at prices of less than $40 per barrel.

In contrast, U.S. shale oil costs between $90 to $100 per barrel to produce, and even the most cost-effective wells in Texas generally require a global oil price of at least $40 per barrel in order to be profitable. So, Iraq can afford to pump and sell oil at prices below those of most other producing nations.

These production advantages have been visible during the recent Saudi Arabian oil-production war designed to bankrupt U.S. shale-oil producers. While oil producers in the U.S. and elsewhere have been severely impacted by the Saudis’ overproduction, Iraq continues to produce profitably.

Oil Drives the Iraqi Dinar

Given the world’s insatiable appetite for oil and gas, Iraq’s dominant supply role is likely to become even stronger going forward. Although it’s difficult to predict the future with certainty, it seems likely that sometime in the near future Iraq will grow into a regional and international energy super-power based on its rich reserves.

In fact, Iraq seems on-track to replace Saudi Arabia as the region’s wealthiest, most-developed nation within the next few years.

What does this mean for the Dinar?

A nation’s economy, as well as the value of its currency, depends on its natural resources. Iraq’s exceptionally large oil reserves are like “money in the bank,” available to meet the young democracy’s needs as it continues to grow.

Eventually the value of the Iraqi Dinar should rise to reflect the true value of the country’s oil wealth. This seems likeliest to occur once the Central Bank of Iraq (CBI) frees the Dinar from the artificially-low value placed on it in 2003 following the darkest days of Saddam Hussein’s regime.

When that occurs, the strength of Iraq’s economy will rapidly become obvious to all observers worldwide, not simply those few individuals who have taken the time to research it.

In any event, knowledge is the key to success. To learn more about the status of the Iraqi oil industry and how it affects the Dinar, click below.