| Visitors Now: | |

| Total Visits: | |

| Total Stories: |

| Story Views | |

| Now: | |

| Last Hour: | |

| Last 24 Hours: | |

| Total: | |

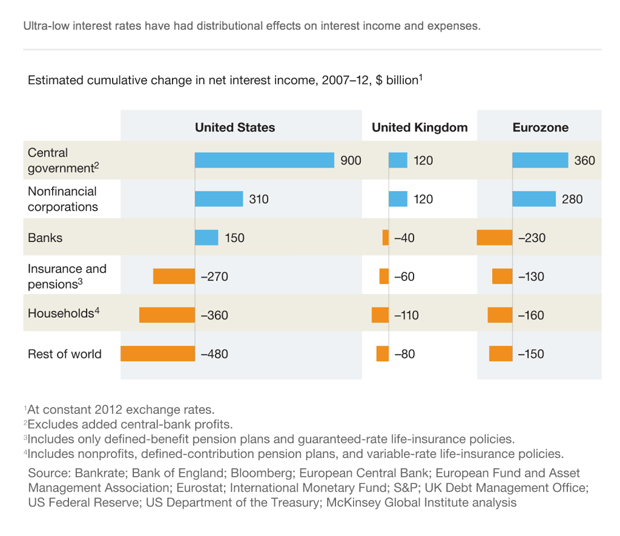

US and European governments gained $1.6 trillion from low interest rates on the backs of over 50 year old savers and pensions

Sunday, December 1, 2013 9:31

% of readers think this story is Fact. Add your two cents.

A McKinsey Global Institute report examines the distributional effects of these ultra-low rates. It finds that there have been significant effects on different sectors in the economy in terms of income interest and expense. From 2007 to 2012, governments in the eurozone, the United Kingdom, and the United States collectively benefited by $1.6 trillion both through reduced debt-service costs and increased profits remitted from central bank. Younger households that are net borrowers have benefited, while older households with significant interest-bearing assets have lost income.

Source: http://nextbigfuture.com/2013/12/us-and-european-governments-gained-16.html